Gaining practical experience without putting real money at risk is essential for trading success. Virtual funds allow traders to practice their skills and acquire confidence before trading with real money in a risk-free environment. In this article, we will look at what virtual funds are, what they can do for you, and where you can obtain these helpful tools to get started in trading.

What is Virtual Funds?

Virtual funds in trading typically refer to simulated or imaginary money that traders use for practice within a risk-free environment. This is frequently accomplished via virtual trading platforms or demo accounts supplied by brokerage providers. People may use virtual funds to learn about the financial markets, test different trading techniques, and become acquainted with the trading platform without putting their own money at risk.

Virtual funds refer to simulated or imaginary money that traders use for practice within a risk-free space

Virtual funds and real money trading differ significantly in terms of risk, emotion, and market impact. When using virtual funds, traders engage in simulated environments where losses and gains are not real, giving a risk-free space for learning and experimenting. Because the lack of actual financial implications may influence decision-making differently, the emotional impact is less prominent.

Furthermore, virtual trading platforms may not fully mimic the liquidity and market impact of real trades. With each transaction, the transition to real-money trading involves genuine risk, increased emotional intensity, and the possibility of market influence. For long-term success, the psychological readiness necessary for managing real money includes a higher degree of discipline, risk management, plan execution, and emotional resilience.

Benefits of Virtual Funds

Virtual funds offer a range of benefits for traders, particularly those who are new to trading or want to refine their skills. Here are some of the primary benefits of virtual funds:

Risk-free learning

One of the key benefits of virtual funds is that traders can learn without the fear of financial loss. This risk-free learning experience allows them to explore different asset classes, experiment with various strategies, and enhance their understanding of market movements.

Platform familiarity

Traders can use virtual funds to familiarize themselves with the features and operations of trading platforms. This involves learning how to execute trades, analyze charts, make stop-loss orders, and use the platform’s different features. This is especially important for novices who are exploring a platform for the first time, as it will assist them in gaining confidence and efficiency in completing trades.

Strategy testing and refinement

Virtual funds enable traders to test their trading strategies, which may include technical analysis, fundamental analysis, or a combination of both. This helps them identify which ones are beneficial and correspond with their risk tolerance and financial goals. In addition, based on the outcomes of their virtual trading experiences, they may alter their tactics and construct a solid and personalized trading strategy.

Realistic market conditions

Many virtual trading platforms strive to replicate real market conditions as closely as possible. This includes real-time price quotes, market depth, and order execution, providing users with a practical experience of how markets behave without exposing them to actual financial risks.

Confidence building

Virtual funds also help build confidence in traders. Traders who achieve success and skill in virtual trading are more likely to tackle actual trading with higher confidence and competence. Additionally, they can prepare for the emotional side of trading. While the emotional effect is not as strong as in live trading, it nevertheless serves as a basis for learning how emotions influence decision-making.

Where to Find Virtual Funds

If you want to achieve success in trading, finding the right source of virtual funds is pivotal. You have a wide range of options to choose from as long as the chosen option aligns with your trading goals and preferences.

Online trading platforms

Independent online trading platforms provide virtual trading options. These platforms may cater to traders with various preferences, offering simulations tailored to specific asset classes or trading styles. Exploring different platforms helps traders to find the most suitable one.

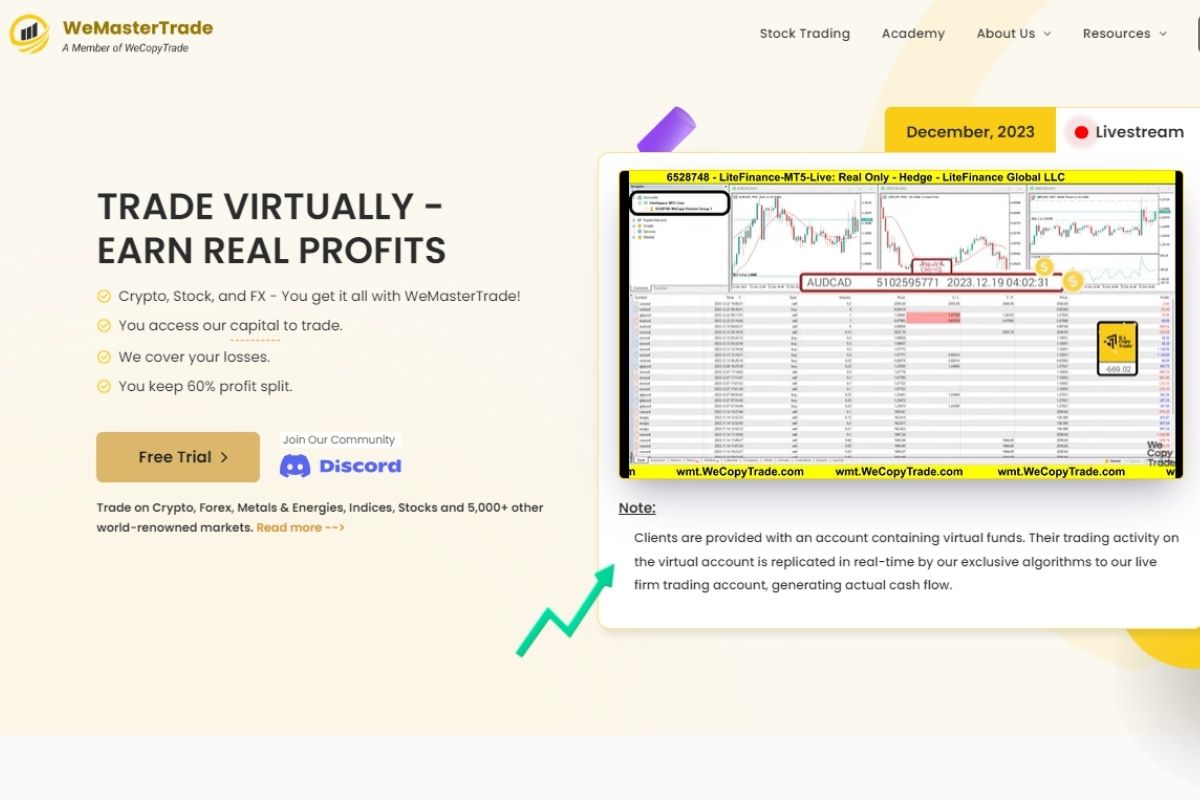

At WeMasterTrade, the virtual funds program delivers a great opportunity for traders to access a comprehensive demo account that mirrors real market conditions, offering a risk-free setting to hone their skills and test strategies. The user-friendly platform allows individuals to execute trades, practice risk management, and familiarize themselves with trading tools.

Brokerage firms

Virtual funds are also available as a service from many reputable brokerage businesses. When traders sign up with these organizations, they frequently obtain access to demo accounts that simulate actual market circumstances. This allows users to practice executing trades, managing portfolios, and testing strategies in a risk-free environment.

Educational Websites

Many financial education websites and trading schools use simulated funds in their instructional tools. These platforms attempt to provide traders with the information and skills they need to be successful traders. Virtual funds become a practical instrument for students to apply theoretical knowledge in a hands-on context.

Trading Apps

Mobile trading applications are becoming increasingly popular, and many of them integrate virtual trading functions. These apps allow traders to practice trading on the fly by seamlessly merging virtual and actual trading activities. Traders may look through these applications to locate a user-friendly platform that meets their needs.

Tips for Utilizing Virtual Funds Effectively

Here are some essential tips to make the most of virtual funds and maximize their impact on your trading journey:

- Set attainable goals: Begin by creating achievable goals for your virtual trading experience. Define your goals (for example, mastering a certain technique, knowing a specific market, or developing your general trading skills).

- Treat it like real money: Approach virtual trading with the same focus and discipline as real money trading. Follow your risk management rules and trading methods with the virtual money as if they were your own.

- Experiment with different strategies: Virtual funds give you an amazing opportunity to test various trading strategies. This risk-free approach helps you discover what works best for your trading style.

- Learn from mistakes: Embrace mistakes as learning opportunities. If a deal goes against you, investigate why it happened and what changes you may have made.

- Keep emotions in check: While virtual trading may not elicit the same emotional intensity as real money trading, it is important to practice controlling your emotions. This mental discipline will come in handy when it comes to live trading, where emotional control is essential.

Conclusion

Virtual funds are indispensable tools for traders looking to enhance their skills before trading with real money. Whether provided by online platforms, brokerage firms, educational websites, or trading apps, these simulated accounts offer a risk-free environment for learning and experimentation. Treating it like real money, learning from mistakes, controlling your emotions, etc. will help you make the most of simulated funds. Are you eager to learn more about virtual trading and useful trading tips? Visit our website at https://wmt.wecopytrade.com/.