What is the best method to get started in trading? Demo trading platforms are the solution for many people. Trading platforms, according to the product, give a practice environment in which you may hone your talents. You may practice trading without risking any real money. The notion is accessible in a variety of financial markets, such as cryptocurrency, gold, forex, and so on. This is a comprehensive guide for you to choose the right trading demo platform.

What is a Trading Demo Platform?

A trading demo platform is basically a program that allows users to simulate the stock market trading process for free. Other names for trading demo platforms include demo accounts and paper stock market free trading simulators. A free trading platform is intended to imitate the real-world experience of trading in the stock market using a broker’s platform without putting any money at risk.

Most free trading platforms supply a lump sum of fictional money and simulate the present ebb and flow of the stock market in real-time. Free trading platforms are popular because they allow beginner traders to learn how to trade equities.

Benefits

- Learning how to use the trading interface and avoiding common errors such as placing orders by accident

- Testing trading strategies without putting real money at risk – if a strategy fails in a demo trading account, you lose nothing. If it works, you now have a real-world trading method.

- A real-time stock market simulator will assist you in better understanding financial markets and the assets in which you want to invest.

- Before putting your hard-earned money to an automatic system, you may also utilize a trading simulator to analyze automated trading software.

Disadvantages

- Replicating unrealistic trading behavior: Simulating real-life trading behavior is challenging when investors are not trading with their own money. When confronted with genuine losses, investors may be inclined to make hasty choices, but virtual traders may be more ready to ‘wait and see’ if their portfolio falls into the red.

- Trading in higher-risk assets: Because demo accounts provide leverage, virtual traders may trade in higher-risk products than they would otherwise. This kind of trading involves borrowing money from the supplier in order to conduct higher-value transactions, which is often utilized with derivatives such as CFDs.

- Ignoring individual goals: While demo accounts are a good method to practice trading, investors should consider their personal goals and risk tolerance before trading with their actual money.

How to Choose The Right Trading Platform Through Demo Platform?

Choosing the right trading demo platform is as difficult as choosing the real trading platform. It greatly determines the success of your investment process.

Understand your needs

Even if it is a free trading platform, think about what you need in an online trading platform before clicking on brokerage advertisements. The answer may vary greatly depending on your investing goals and where you are on the financial learning curve.

If you are just getting started, services such as basic instructional materials, comprehensive glossaries, rapid access to support persons, and the ability to execute practice trades may be required before investing real money.

Know your goals

Are you a short-term trader seeking rapid profits or a long-term investor seeking consistent growth? Do you want to specialize in Forex or gold trading, or do you want to diversify across different asset classes? Understanding your objectives will direct you to trading demo platforms that provide the essential tools and functionality.

Examine trading tools

A solid demo trading platform should have a variety of trading tools and technical indicators. These tools enable you to make educated trading choices, understand market patterns, and efficiently execute transactions. Look for systems with real-time data, customizable visualizations, and risk management tools.

Must have friendly user interface

Examine the trading platform and see whether the overlay appeals to you at first look. To function efficiently with any online trading demo platform, you must understand its complexities. When you access the website, you should be able to see the basic icons and options.

Check additional features

The greatest trading platform on the web is the one that fits your present trading needs. To learn fast, it is typically advisable for beginners to start with something simpler. If you want to become better, your platform should provide everything you need. As a consequence, finding a trading platform with a strong product offering is critical.

Research fees

While other variables may be more significant, you need to know how much you will have to spend to use any certain trading platform. If you use the demo platform, you should also be aware of the actual account costs, since this is one of the variables that will decide whether you will use it in the long run.

For certain platforms that provide capabilities and offers that their less priced rivals do not, a slight premium may be appropriate.In general, you should try to surrender as little of your investment earnings as possible to accounting and trading fees.

You can easily determine which online platforms are too pricey to study and which are just incompatible with the kind of trade you’re interested in with a little investigation.

Top 5 Trading Demo Platform

Here, we examine the top eight trading demo platforms so you can pick which is best for your approach and trading adventure.

Wecopytrade

Wecopytrade has a user-friendly layout that makes it accessible to both experienced and novice traders. The platform’s architecture and features make duplicating deals easier.

Their copy trading tool enables users to instantly duplicate successful and experienced traders. This allows less experienced traders to learn from more experienced investors’ tactics and perhaps attain comparable outcomes. On their trial trading platform, you can also experiment with copy trading.

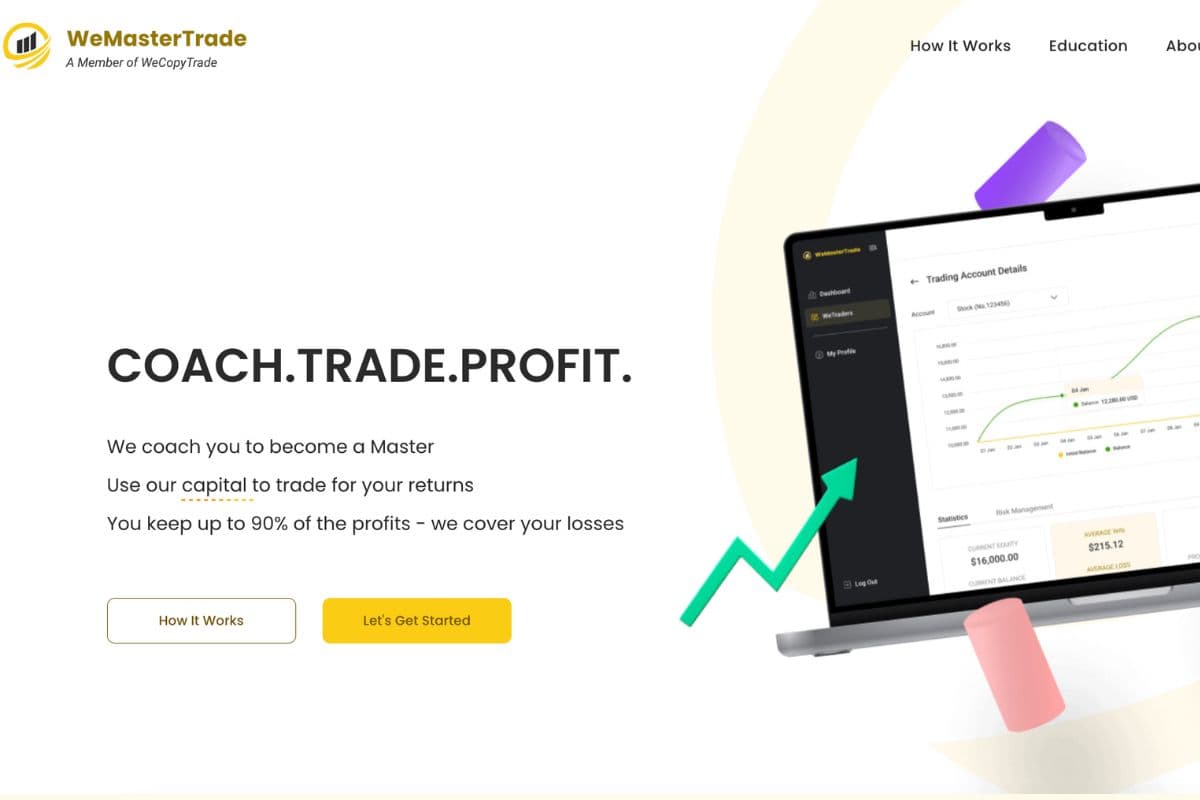

They also have a funded trading program called WeMastertrade. For beginner market players, WeMasterTrade is an excellent one to access capital to optimize the revenue generated during the investment process. They are devoted to long-term partnerships with traders by providing the best atmosphere for them to develop and succeed.

Kraken

Kraken Futures provides traders with leverage, allowing them to increase the size of their trading positions by borrowing cash from the platform. Leverage, on the other hand, may raise prospective growth and losses, thus it entails a bigger risk. Traders must carefully manage their holdings and use suitable risk management measures.

The platform includes sophisticated order types, charting tools, and real-time market data to improve the trading experience. It also prioritizes security and dependability, putting in place safeguards to protect user cash and offering a solid trading infrastructure.

TradingView

TradingView has established itself as a highly acclaimed platform within the financial sector, offering traders a full set of tools and functions, including demo trading. It is well-known for its powerful charting skills and ability to link traders all around the globe.

TradingView’s large range of technical analysis indicators is one of its most notable features. These indicators enable you to study price trends, spot patterns, and determine when to join or leave positions. Whether you are a novice or a seasoned trader, the platform provides a variety of indicators to meet your trading techniques and tastes.

Binance

Binance offers a wide variety of cryptocurrencies to traders, enabling you to diversify and build your portfolios. Trading altcoins allows you to spread risk across several projects, sectors, and technologies, possibly lessening the effect of any one cryptocurrency’s performance.

On Binance’s trial trading platform, you may try out various cryptocurrencies to see whether they match your strategy. While not all cryptocurrencies will be successful, recognizing promising ones early on will let you join the market at cheaper costs, thereby boosting your returns as these altcoins expand.

ByBit’s

If you’re thinking about margin trading, ByBit’s margin trading platform has a wide range of cryptocurrencies. This enables traders to diversify their portfolios while also taking advantage of trading opportunities in other cryptocurrencies.

Margin trading also allows for short-selling, which allows traders to benefit from dropping prices. This strategy is often used in a negative market or when traders expect a decrease in the value of a certain coin.

ByBit’s trading demo platform enables you to experiment with various margin trading methods in order to boost your confidence and abilities.

WeMasterTrade provides a number of incentives, as well as training sessions and blogs that provide traders with in-depth knowledge. To test it out for yourself, go to https://wmt.wecopytrade.com/ and join up for funded and demo trading.