Whether you are a newcomer to the trading world or simply want to test your trading strategies before risking your real capital, trading demo is an ideal option. It enables you to refine your trading abilities in a risk-free setting, offering a simulation of real-market dynamics. In this article, let’s delve into the advantages of utilizing a demo account and why it is beneficial for both newbies and seasoned traders.

What is Trading Demo?

Demo trading, or virtual trading, is a type of trading environment that allows traders to simulate real-world trading of financial assets, such as stocks, bonds, cryptocurrencies, or commodities, without using real money. Instead, demo traders use virtual funds to execute trades and gain experience in the market. Trading demo is essential for anyone aiming to succeed in the market.

This type of online trading also provides access to multiple resources and platforms with updated data. This helps traders gain a better understanding of the financial market before trading with real cash. In addition, effective features including advanced charting systems and risk assessment allow them to test different plans and improve their skills.

Demo account for newbies

For newcomers, trading demo is an amazing opportunity to try trading without using even a penny. Currently, almost all medium and large brokers help users open a demo account in just a few seconds. It helps newcomers understand the process of buying or selling an asset on a trading platform. Furthermore, it assists you in getting familiar with the trading platform without the need to open a real account, which the trader will have to work on if he/ she decides to cooperate with this broker.

Demo account for the experienced

Not only newbies but also seasoned traders use demo accounts. It is crucial to test any trading strategies on demo accounts and only then start real trading. This is due to the fact that trading in the real market always comes with risk. Lots of trading plans do not work and unanticipated flaws may occur. If these happen on a real account, your money can be lost. However, with demo accounts, they do not exist.

Benefits of Trading on a Demo Account

Here are some of the main advantages of using a demo trading account:

Risk-free Practice

One of the most notable benefits of trading demo is the ability to practice without using your real capital. Whether you are a newbie learning basic knowledge or a seasoned trader testing new trading plans, a demo account offers a secure space to make mistakes and learn from them. By trading with virtual funds, you can gain significant experience and confidence before starting live trading.

Get Acquainted with the Trading Platform

Each trading platform has its own features and user interface. Using a trading demo account, you may become acquainted with the platform without incurring any risks. You may experiment with different order types, charting tools, and technical indicators to see how they function and which ones are best for your trading style. When you transfer to real trading, this knowledge will help you use the platform more quickly.

Test Trading Strategies with Trading Demo

You can use a demo account to test and fine-tune your trading methods. You may test several tactics, indicators, and periods to determine which ones produce the greatest results. You may develop your approach, find strengths and weaknesses, and make required modifications by studying the outcomes of your transactions. This iterative approach enables you to improve your trading abilities and boost your chances of success while trading with real money.

Understand the Volatility and Conditions of the Market

To become a successful trader, it is critical to understand market volatility and market conditions. Keep in mind that market circumstances can change rapidly, so ongoing research and adaptability are essential to successful trading. Below are several key points to consider:

Study historical data

The first thing to take into account is analyzing historical price data. This helps you identify patterns and trends, understand how the financial market has behaved in the past, and make informed predictions about future movements. Remember to utilize technical indicators and charting tools to assist in your analysis.

Stay updated with economic events

Economic events including interest rate decisions, employment data, GDP reports, and so on can significantly impact the financial market. Keep up with economic news to predict potential market movements and make adjustments to your trading strategies if necessary.

Utilize volatility indicators

Indicators of market volatility, such as Bollinger Bands and Average True Range (ATR), can give insight into market volatility levels. Based on current market circumstances, these indicators can help you choose the best period to initiate or exit transactions.

Monitor market sentiment

Market sentiment refers to traders’ general attitudes and sentiments about a certain asset or market. To evaluate market mood, look at sentiment indicators such as the CBOE Volatility Index (VIX) or the put-call ratio. This data can assist you in making trading decisions that are in line with market sentiment.

Follow fundamental and technical analysis

Fundamental analysis entails evaluating economic, social, and political issues while technical analysis examines price charts and trends that have a great impact on market movements. When these approaches are used together, it is possible to gain a thorough picture of market conditions.

Utilize risk management strategies

Volatility in the market creates both possibilities and threats. Proper risk management tactics, including stop-loss orders and position size, are critical for protecting your cash during unpredictable market conditions.

Learn Effective Risk Management

Effective risk management is pivotal for capital preservation and loss minimization. Trading on a trial account allows you to try out different risk management strategies without risking your money. You may practice risk-reward analysis, set stop-loss orders, and decide position sizes. You will be better equipped to safeguard your investments while trading with real money if you practice risk management in a risk-free environment.

Build Confidence and Discipline

Confidence and discipline are key aspects of becoming a successful trader. The following tips will help you develop these valuable qualities:

- Set attainable goals: Setting achievable goals will give you a sense of direction and purpose. Your confidence will naturally grow as you complete each one.

- Keep a trading journal: Trading demo will help track your progress and learn from your mistakes. Keep track of your strategy, transactions, emotions, and results. Regularly reviewing your diary allows you to see patterns and opportunities for improvement.

- Stick to your trading plan: Maintaining discipline requires a well-defined trading plan. Outline your criteria for entry and exit, risk management guidelines, and general strategy. Following your strategy consistently will help you develop discipline over time.

- Practice patience: Patience will preserve your capital by preventing you from initiating transactions that do not satisfy your requirements.

- Control your emotions: Recognize and regulate your emotions when trading to improve your emotional intelligence. Avoid trading in retaliation after a loss. Maintaining emotional control will allow you to make reasonable decisions based on analysis.

- Learn from your mistakes: Mistakes are an unavoidable aspect of the trading process. Each mistake brings something new that will help you grow. You need to assess them and make necessary adjustments.

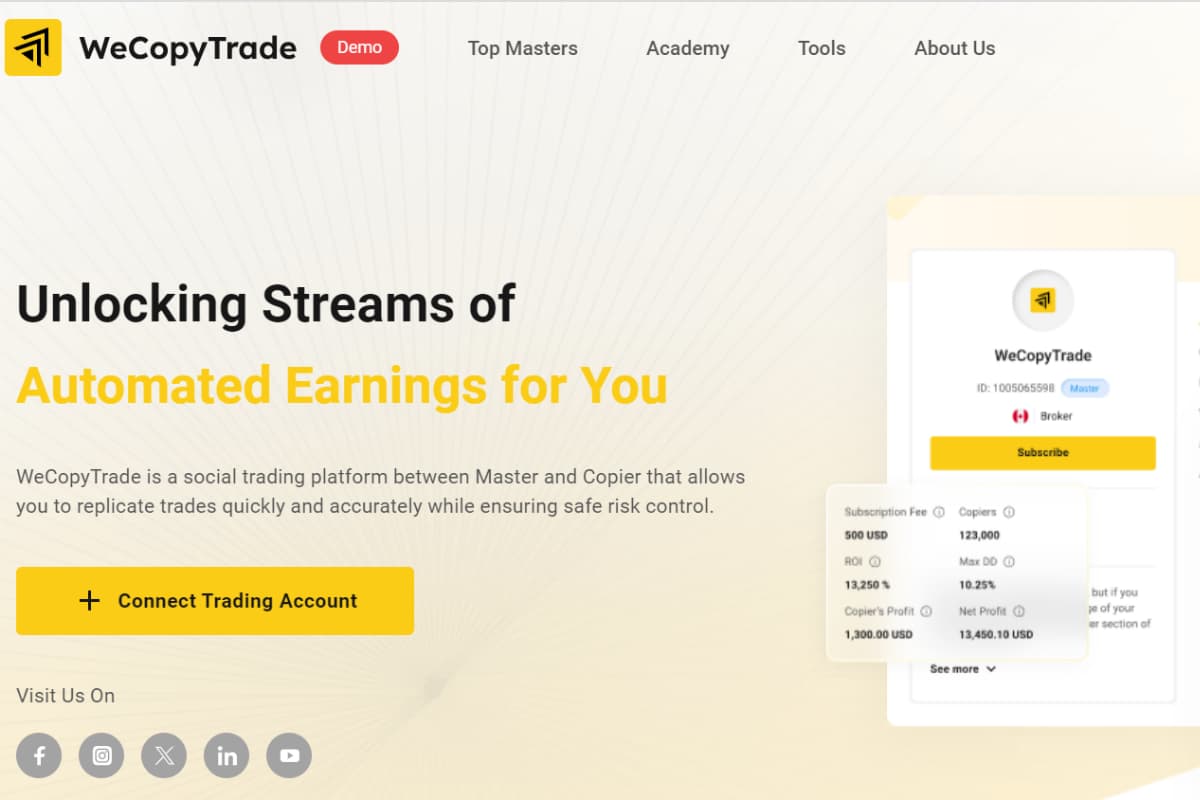

WeCopyTrade – The Reliable Trading Platform with Amazing Demo Trading Feature

WeCopyTrade is a trustworthy trading platform for both newbies and professionals. This platform simplifies the process of trading, offering many outstanding features such as easy selection, accurate statistics, risk management, knowledge enhancement, and so on. Especially, it also provides the unique feature of demo trading with an easy-to-use interface to empower you further. It offers a transparent experience, enabling you to test new strategies without risking your real money.

Trading demo is an indispensable step for anyone looking to succeed in the financial market. It offers a risk-free environment for strategy testing and skill development. Remember to harness the power of a demo account to improve your trading skills and increase your chances of profitable trading. Learn more about helpful trading tips on our website https://wmt.wecopytrade.com/blog.