To become a professional trader, you must have significant investing capacities – both time and money. In recent years, technological advancements and other advances have made simulator trading platforms available to some but not everyone. These programs may simulate numerous traded asset classes such as stocks, currencies, cryptocurrencies, and commodities. Significantly, there are many free trading simulators for you to try!

What is a Free Trading Simulator?

A stock market free trading simulator is simply an application that enables users to replicate the stock market trading process at no cost. Demo accounts and paper trading platforms are other names for stock market simulators. A stock market simulator is meant to simulate the real process of trading in the stock market using a broker’s platform without putting any cash at risk.

Most stock market simulators provide a lump amount of fictitious money and replicate the stock market’s current ebb and flow in real-time. Stock market simulators are popular because they enable inexperienced traders to experience what it’s like to trade stocks.

Why Do We Have to Use a Free Trading Simulator?

A stock simulator may be helpful in a variety of reasons. We’ll go through two of the most popular ones here.

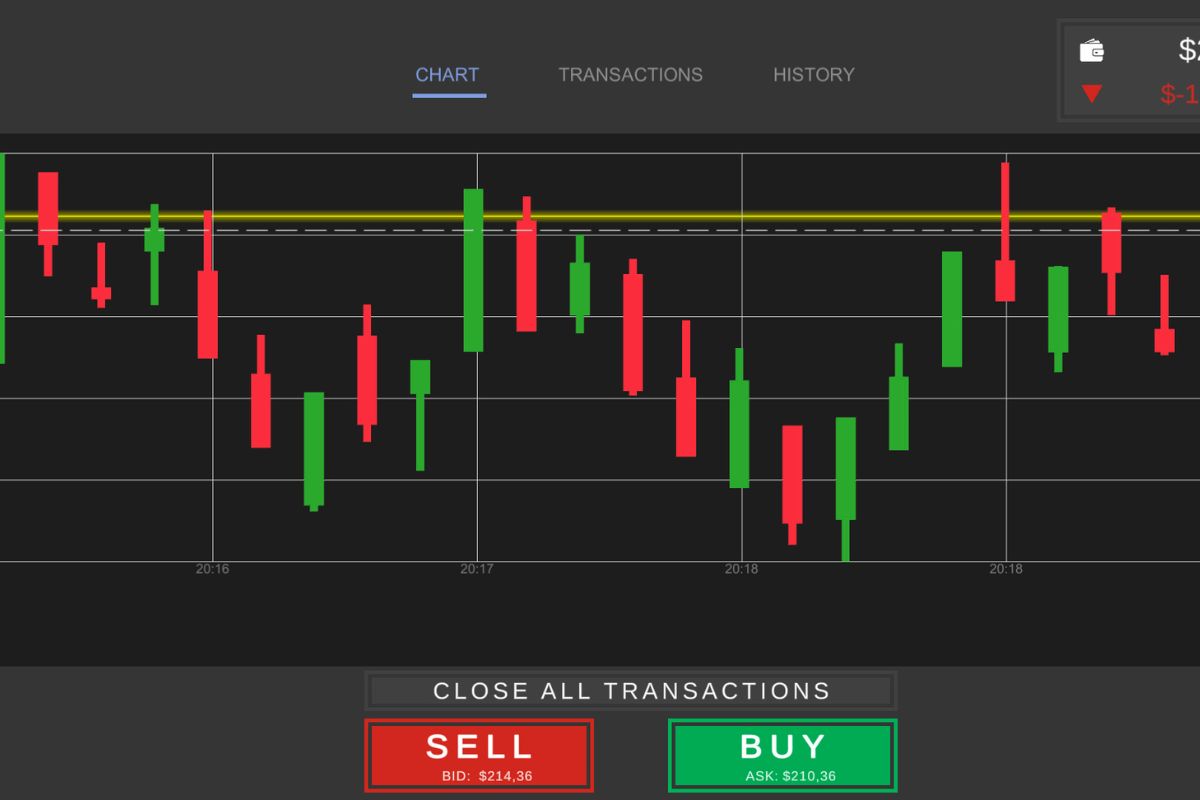

Familiarity with different markets and indices: Beginners who want to get into trading should be familiar with the key markets and indices, as well as keep watch of their movements and learn about their nature. Because it provides a broad range of data, graphic charts, and other trading information, the simulator trading platform may be utilized as a research tool by novice investors.

Gain experience: The simulator trading platform allows traders to practice trading without being under time constraints. It takes time to learn, paying attention to both significant and minute things. Learn how to make more competent judgments by using a free trading simulator

Practice in your spare time: A free trading simulator is accessible on both your desktop and mobile device, allowing you to practice trading methods whenever and wherever you want, 24 hours a day, even when the markets are closed. Because the free trading simulator is web-based, no complicated setups are required. The more you practice, the more you’ll learn, and the effort you put in will eventually pay off. There is always time to test another result on the trading platform simulator.

Also suitable for experienced traders: A free trading simulator is a great approach to examine and test other tactics before copying or adopting them in a real trading environment. Examine how other expert traders fare over time. Follow their past data and develop tactics based on various aspects. Simulated trading is appropriate for all levels of trading.

Benefits and Disadvantages of Free Trading Simulator

Although a free trading simulator is a helpful tool for traders, if you do not know how to utilize it, it will cause some unfavorable parts.

Benefit

- Learning how to utilize the trading interface and avoiding frequent blunders such as accidentally placing orders

- Testing trading methods without risking real money – if a plan fails in a demo trading account, you lose nothing. If it works, you now have a strategy for real trading.

- A real-time stock market simulator may help you comprehend financial markets and the assets in which you wish to invest.

- You may also use a trading simulator to evaluate automated trading software before entrusting your hard-earned money to an automated system.

Disadvantage

The primary downside of utilizing a free trading simulator is that it will never be able to substitute actual trading experience. When trading with real money, a number of things will impact your investing decisions:

- Your risk tolerance and investment strategy

- Your first investment

- Your investment time frame

- Your country’s taxation system

- The anxiety that comes with having actual money at stake

- Strategies for risk management and money management

This causes traders (particularly rookie traders) to make judgments that they would not make if they were trading in real markets. We discovered, for example, that in free trading competitions, traders take excessive risks in order to get the greatest performance and win the reward.

Stock market simulators or demo accounts should be used to test investing techniques and new instruments, not for this reason.

What are the Factors of a Good Free Trading Simulator?

There are several free trading simulators available, but not all of them are effective. You may use the criteria listed below to discover an appropriate free trading simulator for yourself.

The simulator replicates the real-world market situation

The perfect platform for learning how to trade Forex and stocks online should include market data so you can monitor market swings.

With real-time data, you can see how long trading opportunities remain – if you are an intraday trader, you can see the difference that keeping a position open for an additional day or two will make. You can see how a few hours or even minutes may make a tremendous impact if you’re a day trader or scalper.

Because the price fluctuations in the simulator software are comparable to those in the market, you may observe how a specific deal would have been done in a real account in a trading simulator. The only difference is that you’re dealing with virtual currency.

Simply expressed, trading using real-time market data is the only way to advance and learn to trade. Otherwise, your trading choices will be based on something other than how the market performs in real-time, and you may put in a lot of practice time without developing your trading abilities.

The simulator accepts a variable deposit amount

Many free trading simulators allow you to make virtual deposits of up to EUR 100,000. While this may seem to be a terrific way to acquire a lot of trading experience, the fact is that you will only be imitating genuine trading circumstances once you deposit those sums in a live account.

Consider this: with EUR 100,000 in your demo account, you may lose a lot of trades and still have enough virtual money to experiment with. If you then put EUR 1,000 into a live account, you must handle that money more differently since you have less to lose.

Unfortunately, since you were practicing with a much bigger account amount, you would not have mastered risk management, money management, and trading tactics suited for your actual account’s lesser value.

The trading simulator offered by a trustworthy Forex broker

Online brokers provide the majority of stock market simulators and trading simulation software. As a result, it’s critical to ensure that the broker you choose is trustworthy since this will most likely be your platform of choice after you’ve accumulated enough expertise on a trial account.

Online brokers vary in terms of their platforms, offered instruments, trading expenses, and customer service. Consider the following factors when selecting a broker:

- Are they governed?

- Do they keep client funds separate?

- What kind of instruments do they provide? Is it just Forex? Only stocks? Or a combination?

- What kind of trading platforms and tools do they provide?

- How much does trading cost?

- Is there any customer service in your area?

The simulator program includes tools and functions

There are several stock and Forex trading simulators available, each with its own set of features and capabilities. If you concentrate on the most basic or simplest platform, you may need to upgrade later due to a lack of functionality.

In other words, it is preferable to choose the most complex and comprehensive platform in order to lay a solid basis for future trading.

This is why beginning with a sophisticated platform may save you time in the long run. However, if you want to become an intraday forex trader, you will need a sophisticated online trading platform.

If you are a long-term trader who does not want extensive research every day, you may need to choose the most accessible platform for you. Nonetheless, your basic platform should always give you real-time currency rates and other essential features required for long-term trading success.

When evaluating stock market simulators, check for the opportunity to manually test your trading techniques using past data, which is known as backtesting. The advantage of this method is that you may identify specific market occurrences to test trading techniques rather than waiting for a comparable event to occur in real-time and wasting necessary practice time.

Above is the information you need to know about free trading simulation – a tool that will help you a lot on your path to becoming a professional trader. For more information as well as other in-depth knowledge about trading, you can visit https://wmt.wecopytrade.com/.