Ever wonder how you can better trade stock market indices? Indices trading allows trader to catch big moves in the overall stock market. In this blog post, we will cover some of the best strategies the top index traders use to help swing profits. From using trend signals to timing big economic reports, these five techniques can help take your indices trading game to the next level.

Understanding Indices Trading

An index tracks the value of a group of stocks that represent a sector or an entire market. The most well-known indices are the S&P 500, which measures the performance of the 500 largest public US companies, and the Dow Jones Industrial Average (DJIA), made up of 30 large US stocks.

Following an index allows traders to earn from overall changes in related stocks, without having to research every single company. Get familiar with how indices work and which one suit your trading strategy.

Why trade indices?

There are several reasons why trading indices may be an attractive option for investors:

- Diversification: When trading an index, you indirectly own shares in various companies rather than just one. This will help you spread out your risks.

- Lower cost: It is cheaper to trade whole indices than buying stocks individually since you do not have commission fees for each trade.

- Less research: You do not have to pore over the financial conditions of dozens of companies. You just need to follow the overall direction of the index.

- Profit from overall trends: Indices allow you to benefit from macro factors like economic reports that move the whole market at once.

- Less volatility: A diversified index tends to have smaller swings than focusing on just one or two stocks.

Factors that Affect An Index’s Price

Understanding why prices move can strengthen your indices trading strategy. Paying attention to these various influences helps predict how an index may react on any given day.

Several different things can cause an index’s price to rise or fall:

- Economic news: Big reports on employment, manufacturing, inflation, and GDP can sway the whole market at once, causing the price of an index to change.

- Company financial results: The profits and losses of an individual company will cause share prices to rise or fall, which can impact the index.

- Company announcements: Important news from large companies within an index, like new products or mergers, can move shares.

- Changes of composition: Adjustments to which stocks are included in an index, and their respective weightings.

- Commodity prices: Fluctuations in resources like oil, gold, and crops ripple through sectors and influence market direction.

How to Select the Best Index to Trade

Opting for the right index to trade is not simple. Things like the index’s size, its overall performance and volatility, and what time zone the index trades in will affect your decision.

When you pick one to trade, remember that each index has its own features and track a different group of companies. So think about how their unique aspects fit with your strategy and what you are looking to gain.

Here are some tips on choosing the best index to trade:

- Look at the index’s size and diversity: Larger indices like the S&P 500 give traders more diversification across many well-known companies.

- Consider the volatility: Highly volatile indices mean bigger potential moves, but also more risk. Stable indices tend to be lower pressure.

- Review the performance history: Check how the index has performed over various time periods to get a sense of long term trends.

- Examine the sector coverage: Choose an index that focuses on industries you understand well or tracks the broader economy.

- Check the liquidity: Make sure the index has enough daily trading volume so you can easily enter and exit positions.

Top 5 Indices Trading Strategies

With indices trading, great gains can be made by traders who have a great trading strategy. The best index trading strategy is unique to you and combines the fundamental and technical analysis that best aligns with your trading style, preferred indicators, and risk management tactics.

Let us explore the best five methods that will help you dominate indices trading like a pro:

- Trend trading

- Trading retracements

- Trading reversals

- Trading with momentum

- Trading breakouts

Trend trading

With this method, you enter or exit a transaction based on a predetermined continuous trend. When the index moves consistently in one direction, you may predict that it will keep moving in the same direction over the long term and enter long or short positions accordingly.

- If the index is trending up for a while, traders will initiate long trades hoping the momentum keeps going and the price rises further.

- If the index begins trending downward consistently instead, traders will open short trades banking on the trend lasting and the price declining more in the future. The goal is to ride the movement as long as it persists in one direction.

Trading retracements

The next effective indices trading strategy is trading retracements. Index prices rarely go straight up or down, they will usually pull back temporarily against the main trend.

- During an uptrend, traders watch for a small drop in price which is a retracement. When the retracement ends, they get long expecting the uptrend to resume.

- In a downtrend, traders watch for a brief rise which is also a retracement. After the retracement, they get short, expecting the downtrend to continue its downward move again.

Trading with momentum

Momentum trading focuses on riding short-term rises in an index by getting in as it is going up and out when it starts heading back down.

Traders watch for signs an index is gaining strong upward speed and buy to surf the wave higher. They pay attention to indicators like RSI or stochastic to spot when the momentum is peaking. Selling at that peak aims to capture profits from the move before it loses steam.

This style works best for short-term traders since rides tend to last days or weeks rather than months. Try out indices trading with WeMasterTrade.

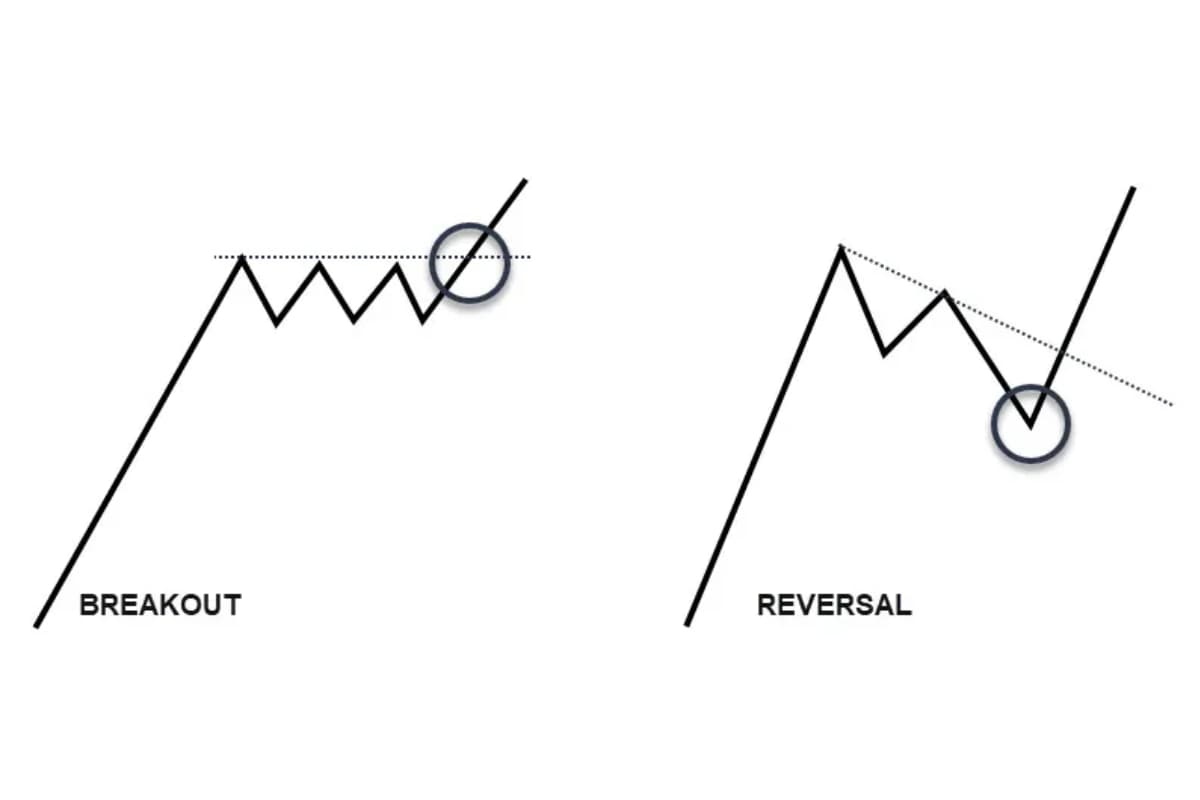

Trading reversals

Traders can also trade indices using reversals trading strategy. A reversal is when an index completely changes direction from an uptrend to a downtrend, or vice versa.

- In an uptrend, if the highs and lows start getting lower over time, the trend may be reversing to a downtrend.

- Conversely, in a downtrend, if the highs and lows begin making higher peaks and troughs, a reversal to an uptrend could be happening.

Technical indicators can help identify if a move against the trend is just a pullback or a full-blown reversal. Traders pay attention to reversals because that signals when it might be time to sell or go short instead of continuing with the previous trend direction.

Trading breakouts

This technique is the act of determining an area in which the index’s price has traded over time. A breakout happens when the index’s price swings beyond this range of values, signaling traders to enter or depart the market. Index traders take positions as soon as a certain market trend emerges.

- If the index rises above the resistance level, that shows the uptrend is likely still ongoing. This signals traders to get long or buy positions.

- If the index falls below the support level, that indicates the downtrend is still in effect. In this case, it cues traders to take short or sell positions.

Crossing resistance or support levels suggests the trend will continue rather than reverse. Traders can use these breakouts to get on board trends still moving in their initial direction.

Final Words

In conclusion, mastering a few key strategies can help you earn big with indices trading. Whether it is trend following, retracement plays, reversal detection, momentum rides or customized blended approaches, finding the right mix for your style and strengths is the path to dominating indices markets. With practice, research, and discipline, any of these approached could help you gain success in indices trading over the long run.

For further trading tips, please visit https://wmt.wecopytrade.com/blog. Or take a real virtual trading on WeCopyTrade.