Following the top traders and learning from their trading decisions is a great way to benefit from the expertise of others. Investors will not only have more motivation but also gain valuable lessons in investing. This blog post will introduce some of the best traders in the world with a proven track record of success. Copying the trades of these traders could potentially help you maximize your trading gains.

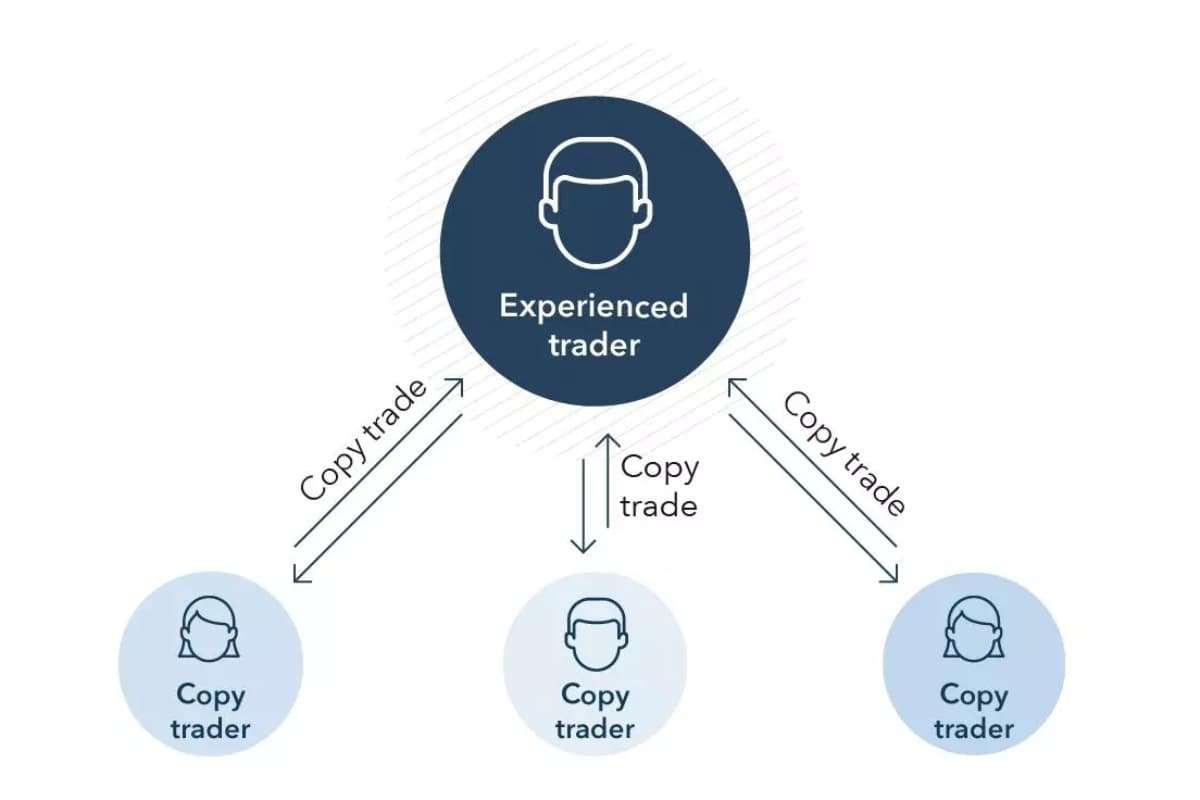

Copy Trading: Copying the Best Traders’ Trades

Copy trading is a straightforward yet effective way for investors to benefit from the skills and experience of the best traders in the world. With copy trading, investors do not need to analyze, speculate, and place the transactions by themselves. Just follow and imitate the executions of a seasoned trader automatically.

Some excellent copy trading platforms allow you to browse top traders and see their past performance so you can select someone with a history of making profitable moves. Replicating the trades of a professional trader is a smart strategy if your goal is to make the highest possible returns from the financial markets.

Copy trading also has significant advantages for the traders since it lets them trade more capital while getting compensated in the form of performance fees, management fees, or even subscriptions.

How to Select the Right Trader to Follow for Maximum Gains?

As a beginners, copy trading is a useful method to learn and trade. However, like any form of investing, it also comes with several risks. You have to study and use your own analysis and judgement while trading. Begin with the first decision: Pick the right trader to copy. Let us delve into some of the most important factors to consider when selecting a professional trader:

- Professional’s trading experience and education: Consider a trader who has a degree related to finance, economics, or has years of proven success in the market.

- Trading style and strategy: Does the trader focus on long term investments or make frequent moves? You should opt for the trader whose trading style matches your own trading goals and risk tolerance.

- Diversity of investment portfolio: A blend of stocks, bonds, commodities and other assets can help reduce overall risk compared to specialists in one area alone.

- Number and frequency of past trades: You should review how many trades the trader makes in a month or year to understand their typical activity level in different market conditions.

- Risk management practices: Successful traders balance risks vs rewards well. You need to see how much they typically risk on trades and what their maximum drawdown has been. Lower risks lead to steadier long term growth.

- Other investors’ results: Going through feedback and results posted by others who have copied the same trader gives valuable insights. Widespread success over many copiers builds more confidence.

Sticking to traders with proven long-term track records, good risk practices, and strategy transparency. This will help you stay aligned with your own investment needs for sustainable profits over time when trading by copying others. Taking some time to evaluate multiple options pays off.

The Psychology of Successful Traders: What to Look for

Psychology is one of the most important aspects in trading. There are some psychological characteristics that top investors possess. Here are the five significant ones to look for when seeking traders to copy:

- Realistic expectations: Instead of chasing quicks wins, experts aim for consistency with an understanding that markets are unpredictable. Unfeasible promises of overnight riches are a red flag.

- Discipline: They stick rigidly to a proven trading plan and do not make impulsive decisions that put their funds at risk, resulting in stable returns over time.

- Patience: Successful traders patiently analyze the market without forcing premature trades. They wait for high-probability setups to present themselves rather than over-trading hurriedly.

- Emotion control: Experienced operators remain calm and focused during volatility, having tools to manage fear or greed at difficult moments. This helps avoid large losing trades from poor judgement.

- Confidence: Top performers feel assured in their strategies due to thorough testing and a history of verified profits over many years of use. This enables them to carry out trades with certainty.

The Best Traders in the World to Copy

Making consistent returns in the financial market can be challenging even for experienced investors. Here is a list of the best traders in the world who you may want to consider copying based on their long-term performance. They all have gained remarkable success with various assets.

Ray Dalio

Ray Dalio is widely considered one of the most successful hedge fund managers ever due to his impressive long-term returns in both stocks and currencies. By thoroughly researching economic patterns and cycles, he developed a “principles-based” approach that focuses more on gradual, sustained profits rather than quick wins.

Copying an expert trader with Ray Dalio’s proven ability to capitalize on shifting market conditions through various stages could lead to strong gains over many years.

George Soros

George Soros is one of the best traders in the world due to his incredible success investing in currency markets. By taking big risks with aggressive trading strategies, he achieved extremely large profits, such as his iconic break of the Bank of England.

While his high-stakes style carries risk, copying someone with Soros’ proven track record of understanding global economic trends could potentially lead to outsized returns. His long history as a self-made billionaire shows he has tremendous skills in identifying opportunities.

Bill Gross

Bill Gross stands out as one of the top investors due to his phenomenal record of expanding wealth through strategic bond and currency trades. By thoroughly analyzing macroeconomic conditions globally, he developed a knack for profiting from global market shifts in both fixed-income and foreign exchange.

His success building one of the largest investment companies on the strength of his own investing skills demonstrates truly impressive trading talents.

John Templeton

John Templeton demonstrated his extraordinary trading talents through the tremendous long-term success of his Templeton Growth Fund in both stocks and currencies around the globe.

By thoroughly researching companies and currencies he saw as undervalued, holding them steadfastly until their worth was realized, he achieved enormous gains for his investors. His career achievements exemplified the potential of remaining dedicated to a proven strategy through all marketplace conditions.

Peter Lynch

Peter Lynch is one of the best traders in the world to copy for maximum long-term gains. As the legendary former manager of Fidelity Magellan Fund, he grew its assets over 600 times ($18 million to more than $14 billion) using his simple “invest in what you know” strategy.

His focus on thoroughly understanding companies has allowed him to identify many winners over the decades. Peter takes a patient approach seeking steady growth rather than quick profits. By mirroring this master investor’s moves, others can benefit from his success in both the stock and forex markets.

Stanley Druckenmiller

As one of the most accomplished hedge fund managers, Stanley Druckenmiller achieved great success collaborating with George Soros. He has demonstrated a remarkable ability to predict market shifts and profit from them.

Druckenmiller’s proven track record of delivering outsized returns to his investors makes him an excellent role model for others. Following his trades could help people benefit from his talent for anticipating currency and other financial movements.

Conclusion

In summary, copying the trades of the best traders in the world is a smart way for investors to potentially increase their profits. Taking time to analyze track records will help choose optimal traders to copy for maximizing your long-term trading results. WeCopyTrade is an excellent place to start if you are new to copy trading due to its easy-to-use interface and extensive list of professionals to replicate. For more trading tips, please visit our WeMasterTrade Blog.