Carbon emissions continue to climb worldwide, and many governments have made finding alternative energy sources a top priority. While there is a focus on innovation and energy efficiency, oil, natural gas, and electricity continue to be the leading energy sources. Trading in the energy business helps to simplify production operations and provide price stability. Given the volatility and worldwide influence of energy prices, traders that engage in energy trading do so for a variety of reasons, including risk hedging, speculation, and industrial production planning. This article will discuss the key features of future energy trading and where to trade

What is Energy Future Trading?

Energy futures trading are derivative contracts that use energy products as their underlying asset. Energy futures allow market players to purchase and sell energy commodities at fixed future prices and dates.

The most common forms of energy futures are based on commodities such as crude oil, natural gas, and electricity. Supply and demand are important factors in determining their price. Unlike other commodities, they are more susceptible to geopolitical events.

Energy futures enable investors to speculate or hedge against price changes or external threats to the underlying commodity. For example, an investment company with a large portfolio of oil and gas equities would be certain to hedge its exposure by acquiring derivatives whose value would rise if the price of these commodities fell.

Other firms that trade energy futures include those looking to lock in pricing ahead of time to guarantee optimum industrial production planning and smooth operating procedures. For example, say a corporation requires extensive oil resources to power its manufacturing facility. In such an instance, it will attempt to secure the requisite quantity at the best available price well before the actual transaction takes place. That way, if the price of oil rises unexpectedly throughout the year, the firm will not face an increase in production expenses.

Advantages and Disadvantage of Energy Future Trading

Energy futures trading, like any other kind of trade, has its own pros and cons.

Advantages

Here are some of the advantages of energy future trading.

- Hedging and risk management: One key advantage of energy derivatives is that they may be used to protect against unfavorable fluctuations in energy commodity prices. Producers, customers, and other market players may set pricing for future deliveries.

- Price discovery: Energy future trading help determine asset prices via market interactions between buyers and sellers. This enables all market actors to make better informed choices about production, consumption, and investment.

- Derivatives may improve market efficiency by transferring risk from risk-averse individuals to risk-tolerant individuals. This risk transfer may help the economy allocate money more effectively.

- Energy future trading may help energy businesses manage risk and get access to cash and liquidity. They also increase market liquidity, allowing players to join and exit positions with greater ease.

Disadvantage and risk

- Market risk: The value of energy derivatives may fluctuate dramatically due to changes in energy prices, geopolitical events, supply and demand, and other economic, fundamental, and technical variables. This volatility may result in large losses, particularly for those utilizing leverage.

- Counterparty risk: It refers to the possibility of the other party in a derivatives transaction failing to fulfill their commitments. In energy futures markets, where contracts may persist for a long period, counterparties’ creditworthiness can be a major worry.

- Liquidity risk: Certain energy derivatives, particularly sophisticated or customized contracts, may have limited liquidity. This makes it difficult to buy or leave positions without changing the price, which may result in losses.

- Legal and regulatory risk: It may impact derivatives holdings, execution tactics, and trading costs. Regulatory compliance is also required to prevent legal consequences.

Tips for You to Optimize Your Energy Future Trading

Many new traders are drawn to energy futures due to its liquidity and profit potential. However, trading them requires proficiency and a thorough grasp of the underlying commodities and their uses.

So, if you want to enter the energy futures market, you need to understand the key elements that influence commodities prices in order to properly manage your investments. Let’s go over the most common elements influencing the price of the underlying commodities to aid you along your path in the energy niche:

Supply and demand

Natural market forces influence commodity prices, just as they do for every other asset. If there is an equilibrium between buyers and sellers, the price will remain steady. If one of these conditions is met, the commodity’s price will rise or fall

The supply and demand for energy products are determined by the status of the economy (both consumer and industrial sectors) and the population’s requirements. For example, if the economy is thriving and people have more discretionary income, they will spend more money. Given that crude oil is essential for the manufacture of numerous items. To meet this expanding demand for commodities, companies will raise their need for crude oil.

Seasonality

The fact that all energy products are utilized for heating and cooling in some form or another should be a warning flag that seasonality has a negative impact on their prices.During the winter and summer, energy use will be greater than normal. On the other hand, energy usage is lower in the fall and spring, when temperatures are stable.

Furthermore, there are peak travel periods throughout the summer, which, when paired with increased energy consumption, influences commodity prices even more.

The good news is that the seasonality effect is reasonably consistent, predictable, and has been shown over and again. This implies that if you follow the fundamental rules, nothing will take you off guard.

Geopolitical Situation

The energy market is an international business, therefore as a trader, you should keep an eye on the changes and ties between the industry’s most notable participants.

To do so, familiarize yourself with the energy mix of the world’s main markets and determine which nations are net energy importers and exporters. Although this may seem to be a convoluted situation, the key forces in the global energy industry are not as diverse.

Begin by keeping a watch on the OPEC countries: the United States, Canada, China, and Russia, for crude oil, natural gas, and coal. You may broaden that list if you want to trade biofuels or renewable energy with certain South-East Asian nations.

Once you’ve familiarized yourself with the energy profiles of the top nations, keep an eye out for macro-level global regulations, limitations, and disputes, as well as local changes inside each of these countries. That way, you can better estimate supply and demand patterns and protect your energy futures trading portfolio from geopolitical risk.

The Build-Drawdown Cycle

Primary energy sources like crude oil and natural gas undergo a “build and drawdown cycle.” Construction involves digging, transporting, and storing raw materials in specialized facilities. The cycle draws down when the product is delivered to the customer.

High demand and low supply decrease stockpiles, whereas high supply and low demand increase inventories. Of course, this affects energy costs. To predict price changes, traders must observe build and drawdown data.

Market dynamics: present condition and predictions

Price changes in energy goods are often caused by a mix of historical data, projections, and assumptions about the market’s future status. These include forecasts for natural gas use throughout the winter months, as well as airline analyses of travel patterns and demand for their services. Market participants may then buy the amount they think they’ll need based on these predictions.

Another aspect that comes under this category is the weather prediction. Parties interested in the energy market monitor weather predictions. This helps them determine if they may anticipate any abnormalities in the winter or summer. This helps to measure their influence on commodity prices. However, the accuracy of weather predictions tends to increase as the season approaches, thus energy merchants must carefully timing the market.

Best Platforms for Energy Futures Trading

Energy futures trading is a one kind of investment. As a result, many trading floors provide not just energy trading but also a wide range of other investments and assets. To join in this thrilling race to profit, please refer to the following renowned platforms!

WeCopyTrade

Wecopytrade‘s interface is user-friendly, making it accessible to both seasoned and inexperienced traders. The platform’s design and features make it easy to duplicate transactions.

Their copy trading feature allows users to rapidly replicate successful and experienced traders. This enables less experienced traders to learn from more experienced investors’ strategies and maybe achieve similar results. On their sample trading platform, you can also try out copy trading.

- WeMasterTrade provides unique packages for all sorts of traders.

- There is no longer any assessment technique or obstacles; WMT will finance you instantly and double your account everytime you hit a 10% profit target.

- To ensure consistent gains, utilize the WMT fund account to duplicate trades from top traders on wecopytrade.com.

- WMT offers a training program for novice traders via Funded Trading.

- Profit sharing begins at 60%.

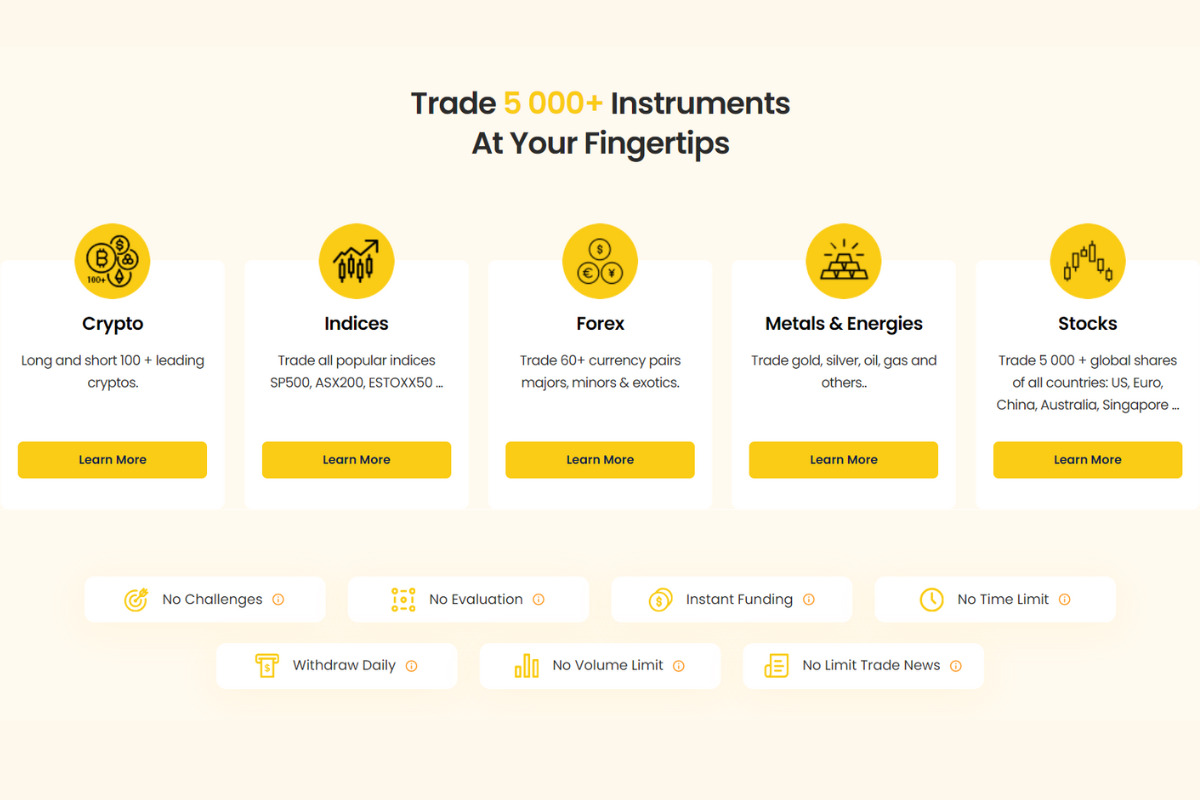

- Stocks, forex, cryptocurrency, metals, energy, and so on are examples of diverse markets.

- WeMasterTrade offers low-cost financing alternatives for novice traders.

- Provide flexible trading circumstances, allowing you to generate money from anywhere on the earth at any time, including the ability to hold positions open overnight and on weekends (only for aggressive accounts).

Interactive Brokers

Interactive Brokers was established in 1978 and was the first business to employ a hand-held computer device on an exchange floor. Since its start, the firm has sought to provide its consumers with the most advanced and sophisticated trading tools available. Historically, the firm has catered to the world’s biggest international traders, who want a single platform that can manage deals in several markets utilizing various trading vehicles.

- Prices range from $0.25 to $2.50 per contract ($5 for crypto futures); IBKR Pro clients pay on a tiered system depending on volume, while IBKR Lite customers pay a flat charge.

- For typical futures contracts, IBKR Lite users pay $0.85 per contract. $0.25 per mini-contract. Cryptocurrency futures range from $0.10 to $5 per contract.

- Standard exchange and regulatory fees apply.

NinjaTrader

NinjaTrader was founded in 2003 to serve active self-directed futures traders. NinjaTrader launched new cloud-based, mobile, and online platforms in March 2023, enabling smooth trading across all platforms. In January 2023, the business unveiled a custom-built trading platform to accommodate event-driven futures.

NinjaTrader platforms are free to use and provide simulated trading without the need to fund an account.

- Option 1 – Free: There is no monthly cost, and per side fees are $0.35 for micro futures contracts and $1.29 for normal contracts.

- Option 2 – Monthly: A monthly charge of $99, plus per-side fees of $0.25 for micro contracts and $0.99 for normal contracts.

- Option 3 – Lifetime: $1,499 one-time payment, with per-side fees of $0.09 for micro contracts and $0.59 for normal contracts.

- All plans are subject to exchange, clearing, and National Futures Association (NFA) fees.

WeCopyTrade offers a variety of bonuses, as well as training sessions and blogs to supply traders with in-depth information about energy future trading and investments. To try it out for yourself, visit https://wmt.wecopytrade.com/ and sign up for funded and demo trading.