More and more people are seeking easy and convenient ways to invest their money. This is why online trading platforms come into play. Investors can trade stocks, mutual funds, and so on for free from their phones or access robust research tools that will help them trade like a pro. In this article, we will explore the best online trading platforms Canada and how to select the suitable one.

Understanding Online Trading Platform

Using an online trading platform, you may buy and sell stocks, bonds, mutual funds, and other assets via your mobile device. Online brokers offer these platforms to make investing easier and more effective.

When you open an account, you are in charge. You decide what you want to purchase or sell and manage your investments. Some platforms have helpful tools like charting tools to see price changes over time. They also give you up-to-date prices and new features.

Many online platforms have lower fees than traditional brokers or even no fees. This makes investing more affordable for everyone. You do not have to pay as much each time you make a trade. Trading online usually costs less than using a regular broker. The low fees and convenience are why more people choose to use online platforms instead of brokers.

Benefits of Using Online Trading Platforms

Online trading platforms offer several advantages for traders as follows:

- Ease of use: With a simple interface, even newbies can easily get familiar with the platform. It is no problem to learn the basics.

- Convenience: You may trade from anywhere at any time the markets are open. No need to call a broker or visit a branch during business hours. Trade on the go using smartphones or tablets as many platforms offer mobile apps.

- Low costs: Most platforms have low or no commission fees per trade. Some may charge annual or monthly account fees.

- Research tools: They provide real-time financial data and news to help you make informed decisions.

- Automation: You can set up automatic investments based on predefined criteria and use automated features for setting stop-loss orders for better risk management.

While online platforms can bring you numerous benefits, you should be aware of possible hazards and conduct thorough research before engaging in trading.

How to Choose the Right Online Trading Platform?

Selecting the right online trading platform is important if you want your investing to go well. Here are a few things that you cannot ignore when selecting online trading software.

Consider your goals

The first thing you must consider at the time of choosing a trading platform is your trading goals. You should narrow down your trading goals. Think about what you want to invest in and what you expect from the trading software you will be selecting. Look into reliable resources like articles, blogs, etc.

User-friendly interface

The platform should be easy to use and have a well-designed interface with all the essential features in front of you. This will allow you to access tools quickly. In addition, the speed of the platform you will be using also plays an essential role in trading. Remember to check the speed so that you can execute trades promptly.

Reliability and security

To trade successfully, ensure you use a reliable and secure platform with a certified broker, a credible license, and robust security protocols. You may consider features like two-factor authentication to save your personal and financial details.

Transparent pricing

Many online trading platforms attract traders by showing their super cheap pricing plans and charging them hidden fees once they subscribe. Look at the costs for trades, account maintenance, and any other fees to get a sense of overall expenses. It is a great idea to look for software with reasonable and clear pricing to avoid unexpected costs eating into your profits.

Reliable customer support

Online trading is a fast-forward process, especially for beginners. This is why having a reliable customer support team is critical. They will help you trade in a hassle-free manner. Therefore, always select the trading platform that offers quick and helpful customer service via various channels such as phone, live chat, and email.

Best Online Trading Platforms Canada

“Is there any online trading platform Canada base?”

Yes! Definitely.

With so many trading software available, you may wonder, “What is the best online trading platform in Canada for me?” To help you find the most suitable one, let us look at the finest online trading platforms in Canada.

WeCopyTrade

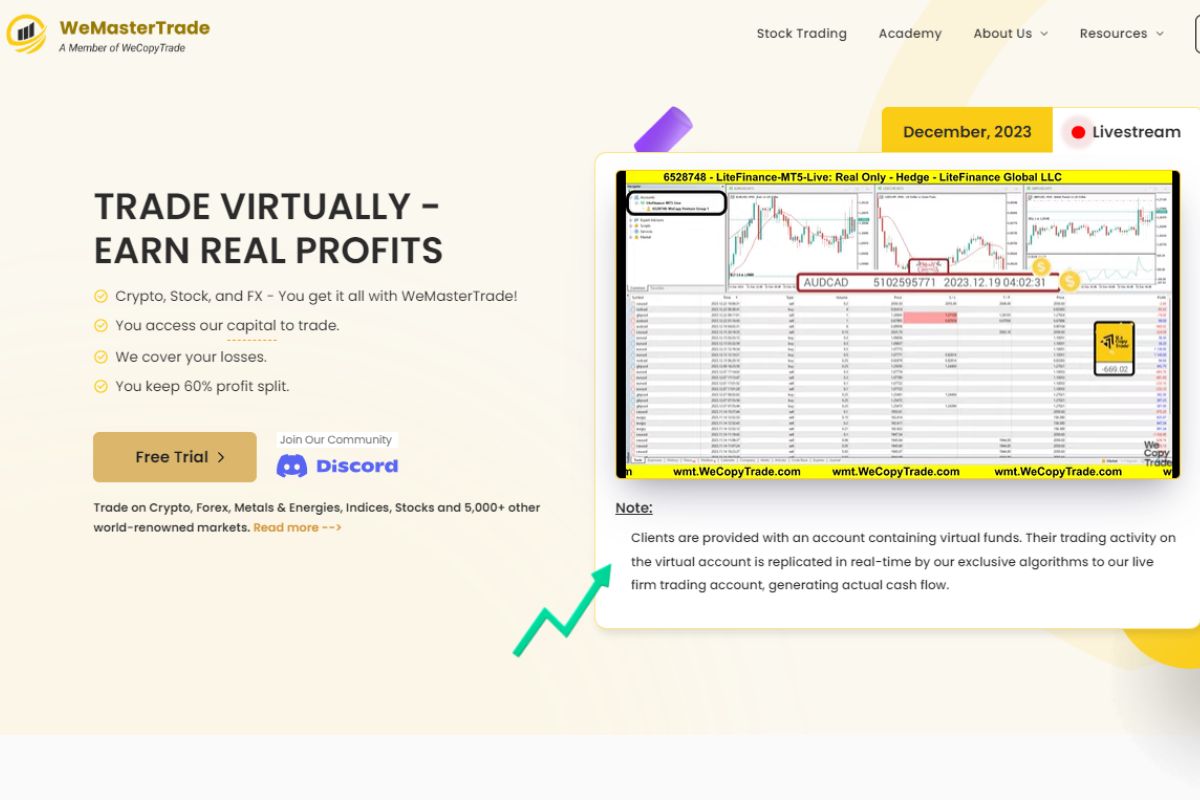

When it comes to the prominent online trading platforms Canada, WeCopyTrade is one of the best choices. It offers a wide range of critical features such as researching and charting tools, risk management, an easy-to-use interface, knowledge enhancement, demo trading, great customer support, and so on.

WeMasterTrade (WMT), a member of WeCopyTrade, provides traders with the greatest environment in which to trade and excel. WMT has all the necessary elements of the best online trading program in Canada for you to select.

- Custom packages for all types of investors

- Diverse markets like Stocks, Forex, Metals, Crypto, Indices,…

- Low-cost financing choices for new traders

- Flexible trading circumstances, traders may make money anywhere at any time

- Accompanying trading programs for newbies, etc.

Wealthsimple Trade

Wealthsimple Trade is a great choice if you do not want to pay any fees at all. You can buy and sell stocks and ETFs without paying a commission. This makes it very affordable to try out investing. The mobile app of Wealthsimple Trade is quite easy to use. However, the platform only supports Canadian dollars, so you can only hold Canadian dollars. U.S. investments will have currency conversion fees.

Questrade

With Questrade, you can purchase and sell exchange traded funds (ETFs) for free. This will be an amazing way for beginners to build a diversified portfolio. The platform charges a little commission on stock trades and does not charge annual fees. Questrade charges low fees for Canadian and US stocks. Nevertheless, you need to have a minimum of $1,000 in your trading account to start.

Qtrade

This platform is well-known for having great customer service by phone or email if you need help with your account. Qtrade offers various resources like watchlists to track your favorites, alerts to notify you of price changes, and screening tools to find investments that match your wants. A minimum account balance is not required, making it easy to start investing smaller amounts.

CI Direct Trading

This platform is owned by CIBC, one of Canada’s biggest banks. You may feel secure knowing a large bank backs the platform. CI Direct Trading is useful for both novices and seasoned investors with tools for research, monitoring prices, and so on. It does not charge fees for accounts over $5,000, however, you need to have a minimum of $1,000 in your account.

Final Words

In conclusion, Canada hosts a variety of online trading platforms that cater to the diverse needs of traders. Whether you are just starting and want something easy, or have experience and want extra tools, there is probably one that suits you. It is important to think about several factors such as user interface, fees, security, and customer support when choosing online trading platforms Canada. Visit our website at https://wmt.wecopytrade.com/ to find more valuable trading guides.