With the continuous increase in gold prices on the world market, more and more investors are starting to invest in gold. However, investors should be aware that every investment has certain risks. To capitalize on gold trends and succeed in this unpredictable market, investors must possess particular trading knowledge. This article will show you different ways to trade gold and some of the best strategies and tips for trading gold. Let’s check it out!

What is Gold Trading?

Gold is a precious yellow metal that people have valued for thousands of years. It can be found naturally in the ground and is used to make jewelry, coins, and other items. It is one of the most trusted currency forms in the world. Gold is also a prevalent investment and an effective way to diversify traders’ investment portfolios.

Gold trading involves buying and selling gold as the price goes up and down. Traders hope to buy gold at a low price and then sell it later when the price rises to make a profit. They watch the markets closely to know when gold may cost more in the future. While real gold is nice to own, most traders today deal in paper contracts that represent gold instead of the actual metal.

Some factors that impact gold prices include:

- Supply and demand: When gold demand is greater than supply, gold prices tend to rise and vice versa.

- Economic conditions: In times of economic uncertainty or inflation, investors often turn to gold as a safe haven asset, driving up its price.

- Geopolitical events: Political tensions, conflicts, or unexpected events may drive gold prices up. This is because investors view gold as a safe place to put their money during risky times.

Whether the price goes higher or lower depends on many factors in the economy. By keeping track of those factors, traders try to predict when gold will be most valuable and the best times to buy low and sell high.

Different Ways to Trade Gold

Here are the main ways to trade gold:

- Physical gold trading: This way, you own gold in form of gold bars or coins. You may buy and sell physical gold through reputable gold dealers.

- Gold stocks trading: You may buy and sell stocks of firms that mine, process or utilize gold in their operations. The stock prices will be affected by gold prices as well as the business performance of the company.

- Gold exchange-traded fund (ETFs) trading: Gold ETFs allow you to invest in gold without needing physical ownership. You can easily buy and sell gold ETF shares like stocks on an exchange.

- Gold futures contracts: Futures contracts allow you to forecast gold prices without needing to own actual physical gold. However, futures contracts carry more risks than other methods.

How to Trade Gold Online

Trading gold online is the most convenient way that traders can use to join the metal markets. You may engage in different gold investment chances from home via digital trading platforms. Here are the essential steps to trade gold online.

Open a trading account

The first step to trade gold online is that you have to open an trading account with a prestigious online trading firm. You should choose the firm that has a user-friendly trading platform, attractive fees, and diverse investment options. You will need to provider some information and ID check.

Besides, it is crucial to use a demo trading account to familiarize yourself with your chosen platform.

Deposit funds into your account

You may fund your trading account using many different payment methods, including bank transfers. Make sure that you have enough money in your trading account to cover your transactions and any losses. Do not forget to check for any required minimum deposit as well as any fees that may be applied.

Monitor price movements

The next step is to monitor price movements using technical indicators. These tools are an important aspect of gold trading. You will need to analyze price charts, identify patterns, signals, and trends that indicate possible price changes. Thereby, you can determine potential purchasing/ selling opportunities, set targets, stay disciplined and control risks.

Place trades and manage your trades

After analyzing price changes and developing a well-structured risk management strategy, you can begin placing trades. It is important to select a trade size based on your plan and what the market is doing. You should also monitor the prices closely and be ready to adjust your trades if needed, to make profits and minimize losses. Using trailing stop orders that move with the market price can also help lock in gains.

Best Strategies for Gold Trading

The gold trading techniques below may help you trade gold effectively:

Trend following

This strategy examines which direction gold prices have generally been moving in. It aims to identify if prices are trending upwards or downwards overall and then make trades in the direction of that trend. This approach tends to work well when the trends have been strong and clear-cut.

Breakout trading

This involves watching for when the prices break above a higher level or below a lower level that has previously resisted further price movement. If indicators like trading volume confirm the breakout, a trader may then take a position. The goal is to earn profits from significant price changes.

Range trading

This approach identifies periods when gold prices fluctuate between an upper and lower boundary. Trades are made near the bottom of this trading range and then closed near the top to benefit from the price fluctuations within the boundaries. It looks to capitalize on sideways-moving markets.

Scalping

Scalping is a more aggressive tactic that attempts to profit from very tiny, short-lived changes in price. It requires rapidly opening and closing trades, sometimes within just minutes. Close monitoring is necessary as positions are taken since losses may occur if the prices move against the trade.

5 Tips for Trading Gold

By following these tips, you may trade gold successfully:

- Consider the exchange rate between your currency and foreign currencies when making gold trades. A stronger domestic currency can make gold from abroad relatively cheaper. However, this does not necessarily mean the value of gold itself will fall. Keep an eye on exchange rate movements.

Keep an eye on exchange rate movements

- Be cautious when buying gold, as gold is best for medium to long-term investment. Do not expect huge short-term changes and only invest a suitable amount. You should only invest an appropriate percentage of your portfolio in gold.

- If you make a losing trade, do not add more risk to compensate. This could just lead to bigger losses. It is usually best to cut your losses short.

- Diversify your portfolio by including a modest amount of gold. This can provide stability when other assets decline.

- For short-term trading, be very careful as gold prices do not fluctuate hugely in short periods. Monitor your positions closely to avoid unwanted outcomes.

Final Words

To wrap it up, there are several important tips and strategies to follow when trading gold. Carefully consider factors like exchange rates, buy gold gradually over time, and do not take on more risk than you can handle with losing trades. It is also wise to include gold as a small part of a diverse portfolio. Following guidelines like these will help you trade gold safely and hopefully achieve good long-term returns. With the right approach, informed traders can profitably trade gold.

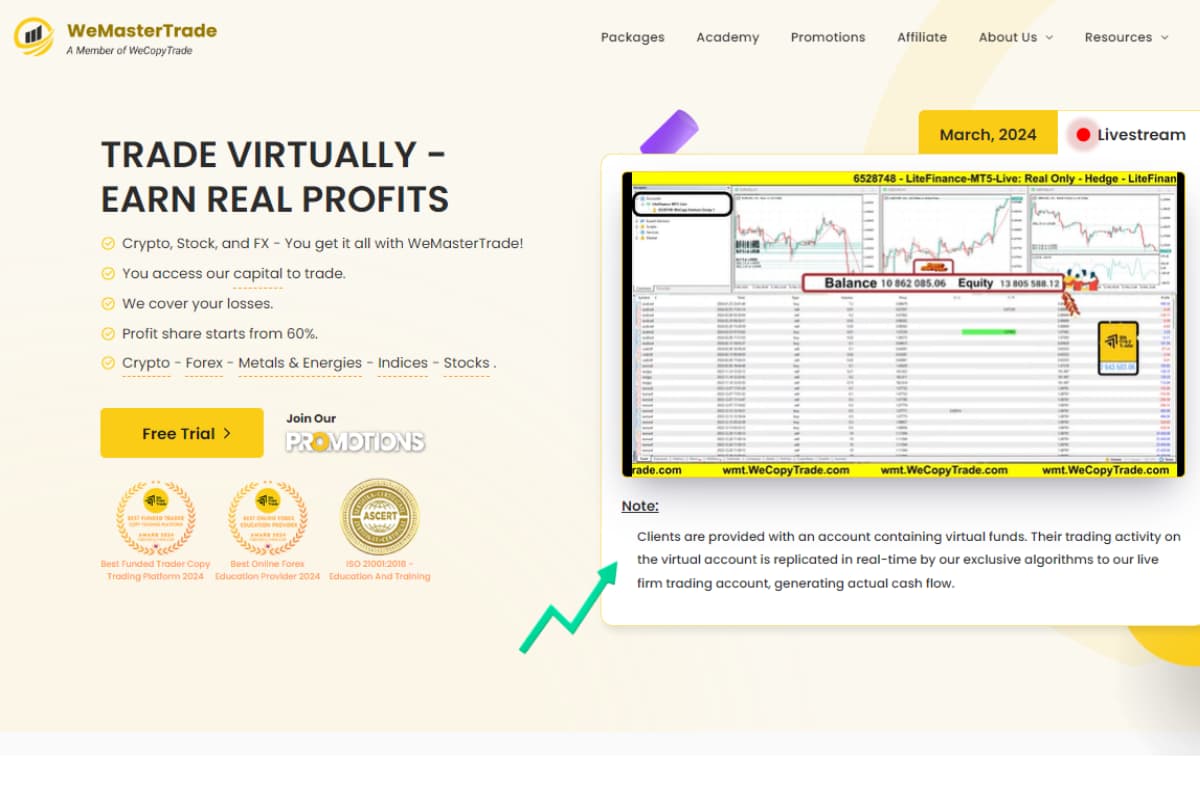

If you are seeking a trusted trading platform to trade gold, WeMasterTrade (WMT) would be a top recommendation. WMT provides traders with a best-in-class platform and tools to capitalize on movements in the gold market. For more essential trading knowledge and useful tips, please check out our website at https://wmt.wecopytrade.com/blog.