Investing in the stock market through the S&P 500 is a great way to help your money grow over time. The S&P 500 lets you invest in 500 large and successful companies in the United States. In this blog post, we will discuss the main characteristics of the S&P 500 index and how to invest in S&P 500 in simple steps so you can work towards a secure financial future.

What is the S&P 500?

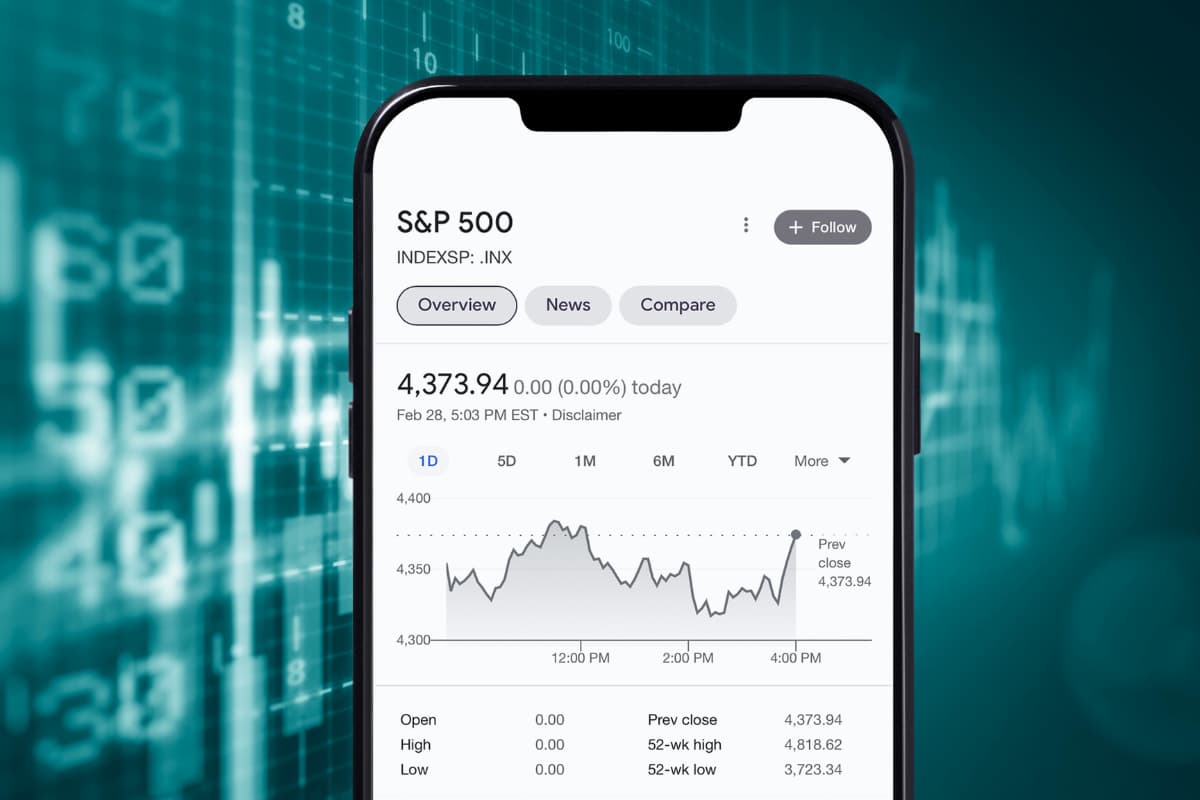

The S&P 500 is an index that follows the 500 largest publicly traded companies in the United States. It looks at the performance of these 500 companies to give investors a picture of how the overall stock market is doing. By tracking so many large companies across different sectors, the S&P 500 acts as a good indicator of how the U.S. stock market is performing overall.

This index includes companies from many different industries like technology, healthcare, financial services and more. Some of the biggest companies in it include household names like Microsoft, NVIDIA Corporation, Apple, Amazon, Meta Platforms Inc, and others.

Benefits and Drawbacks of Investing in the S&P 500

Generally, the advantages of investing in S&P 500 outweigh the drawbacks, especially for long-term investors. Let us delve into the pros and cons of investing in this index.

Benefits

Investing in the S&P 500 is a straightforward way to help make your savings grow without too much effort or risk.

- Diversification: When investing in S&P 500, your mony is spread out across 500 well-known companies in the U.S. This will help minimize your risks. If one company does not do well, it will not sink your whole investment.

- Long-term growth: The S&P 500 has consistently grown over the long run. Investing for the long term can help your money outpace inflation. Your investments will likely grow significantly. You may now start trading indices with WeCopyTrade.

- Low cost: S&P 500 index funds have very low fees, in some cases, nearly nothing. This means more of your money can grow over time rather than paying high fees to managers.

- Easy to invest: You do not need a lot of capital to start. Many funds let you invest smaller amounts each month through your 401k or on your own. No need to pick individual stocks.

Drawbacks

While this index is widely considered a good investment, there are several potential downsides:

- Market fluctuations: The value of your investment will rise and fall with the market. You need to be prepared for short-term volatility and willing to stay invested for the long run.

- Dominated by large-cap companies: The S&P 500 mostly includes large, well-known companies. It does not provide exposure to smaller, growing companies. So you may miss out on opportunities from these types of companies.

- No exposure to foreign companies: Since the S&P 500 tracks only large US companies, you cannot access stocks of other companies in the world that may be growing quickly. Investing in international companies could help add diversification.

Ways to Invest in the S&P 500

There are two main ways to invest in S&P 500, including index funds and ETFs. Let us explore some key differences between these two major options.

Invest in an S&P 500 index fund:

- Index funds track the S&P 500 and provide instant diversification.

- They can only be purchased at the end of the trading day for that day’s price.

- Sometimes have higher minimum investments and taxes.

Invest in an S&P 500 ETF:

- ETFs work like index funds but trade like stocks throughout the day.

- They usually have lower minimum investments than funds.

- ETFs are generally more tax efficient than mutual funds.

In the next parts, we will go over these two approaches to investing in the S&P 500 index in further detail.

How to Invest in S&P 500 with an Index Fund

Index mutual funds that follow the S&P 500 usually include most of the 500 companies in the index. This helps the mutual fund match how the index performs.

How to choose a suitable fund?

Investors can choose from a range of S&P 500 index funds to invest. The goal of these funds is to match how the S&P 500 performs without requiring lots of research or management on your part. Following these factors can help you pick one suitable for your needs and budget.

- Minimum amount to invest: Funds have different minimums, so check it matches how much you have.

- Costs: Index funds do not require lots of managing, so costs tend to be low. These ongoing costs are called “expense ratios”.

- Dividends: Some funds give out dividends, or money companies share with investors. Check the dividend yield, or how much is given out, as higher yields can boost returns.

Steps to invest in an S&P 500 index fund

Buying an S&P 500 index mutual fund is pretty easy. Here are the steps:

- Open an investment account: You can sign up with a prestigious brokerage or automated investing service. Many allow starting with small amounts.

- Add money: Decide how much you can invest and put it in your new account.

- Pick and purchase your fund: Once you choose a fund, buy it through your new account.

If you do not have a lot to start, shop around for accounts with low trading fees. This allows investing affordable amounts comfortably.

How To Invest in S&P 500 with an ETF

ETFs are similar to index mutual funds because they allow investors to own a fund with many different stocks. The big difference is that ETFs trade like stocks throughout the day, while mutual funds only trade at the end of each day.

Not all ETFs follow indexes like the S&P 500. Some focus on specific industries, parts of the economy, or markets. To track the S&P 500, choose an ETF that directly follows that index.

How to choose a suitable ETF?

To select a suitable index-based ETF, you need to consider the following things:

- Minimum: ETFs often have lower minimums to start than mutual funds. Sometimes you just need enough for one share.

- Costs: Always compare the expense ratios between ETFs and pick ones with lower fees.

- Dividends: Look at dividend yields and choose ETFs that pay higher dividends, which can boost your returns over time.

Steps to buy a S&P 500 ETF

Here are the easy steps to get an ETF:

- Open an investment account: Sign up with a regular brokerage or robo-advisor. They offer lots of ETF choices.

- Add money: Decide how much you can comfortably invest and transfer funds to your new account.

- Pick your ETF and purchase: Once you’ve chosen an ETF based on factors like expense ratio and dividends, use your account to buy it.

Final Words

In conclusion, investing in the S&P 500 through low-cost index funds and ETFs is a simple way for long-term investors to build their financial future. There are many options for how to invest in S&P 500 that make it affordable for everyone. Whether you use a mutual fund or ETF, focusing on low fees and consistent contributions can help your investment in the S&P 500 grow over the years. Visit our WeMasterTrade Blog for more useful investing tips.