Do you want to enter the investment market? But afraid you don’t have enough knowledge to win the market? You also don’t have time to research the market and you want to find a master trader to follow and place your investment safely? If this is the case, read the entire article to understand more about how to copy trade. This article provides some knowledge about the advantages, definition, how, and comparison between social trading and copy trading. Let’s get started.

What is Copy Trading?

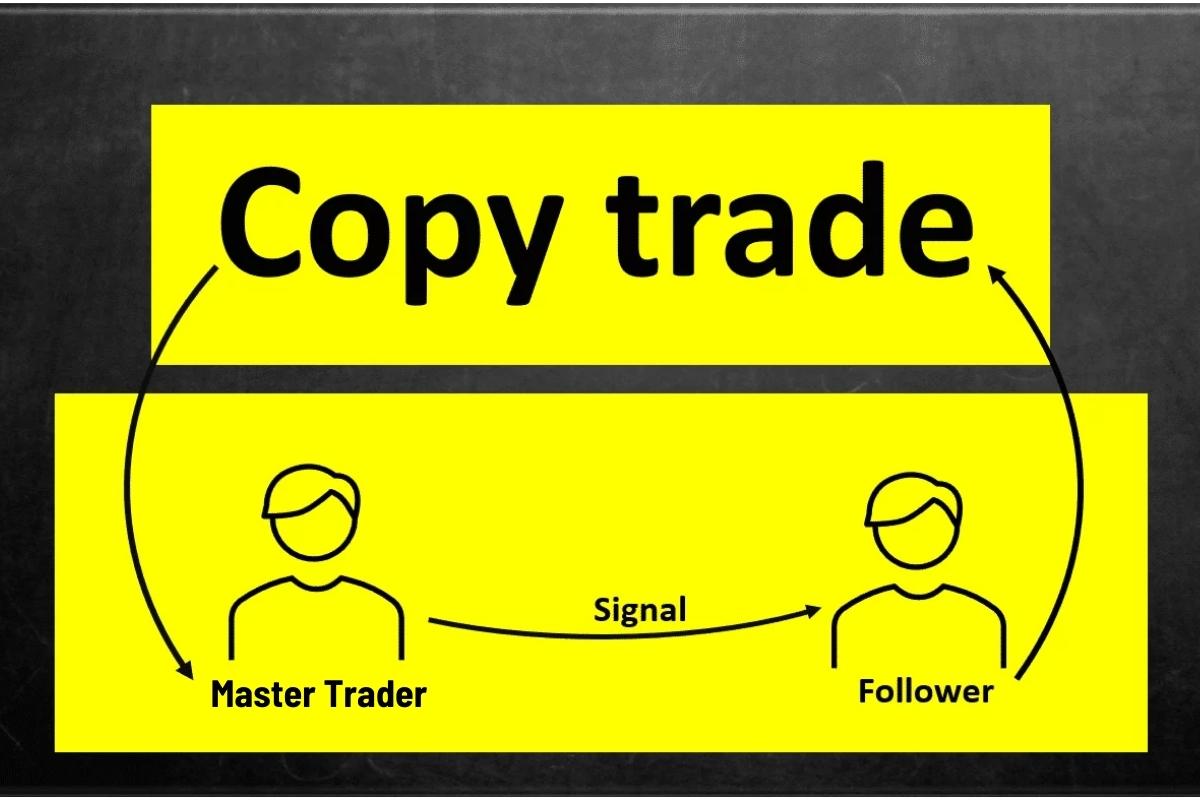

Before discovering how to copy trade, you need to know some basic information about this trading model. Copy trading? That is, trading automatically involves replicating the transactions of other traders. This method is frequently used for newcomers who may not understand how to trade, with the added benefit of helping to teach them along the way. It can be recommended that experienced traders step away from their screens if necessary.

You consider promoting WeCopyTrade, a reputable copy trading platform enabling you to imitate experienced traders’ trades. You can, for example, use WeCopyTrade to assess the output of top traders and then combine tactics that are appropriate for your objectives.

For people lacking the time to invest or trading skills, copy trading may be a great option. As we indicated previously, several brokers develop numerous copy trading capabilities. Many different platforms offer copy-trading services. You can choose to use manual or totally automatic apps, which is excellent. On your website or mobile device, such as the WeCopyTrade app, you simply sit back and observe the activity.

Pros of Copy Trading

Here we list only a handful of the many benefits of copy trading:

- The financial markets are now accessible to new traders, giving them greater trading confidence.

- They can pick up trading skills by imitating other people who are considered “professional traders.”

- Even with little time spent investing and researching, traders may rival in the market.

- A wide range of trading products are available, including money, coins, equities, indexes, commodities, and more. To begin copy trading, you can select the things you enjoy.

How to Copy Trade?

In all financial markets, copy trading is effective. It is applicable to trading in cryptocurrencies, foreign exchange, equities, commodities, metals, and other financial markets.

Many traders who try to copy other traders’ moves are more concerned with their trading results than with the markets they trade. Of course, you can follow traders who only engage in cryptocurrency trading.

It can be a good idea to follow a professional trader with more technical expertise than you do given the relative youth of the cryptocurrency trading market. It makes sense to replicate their moves if you don’t have enough experience trading cryptocurrencies.

Here’s how to copy trade while trading cryptocurrencies.

Step 1. Search for Experienced Traders for Copy Trading

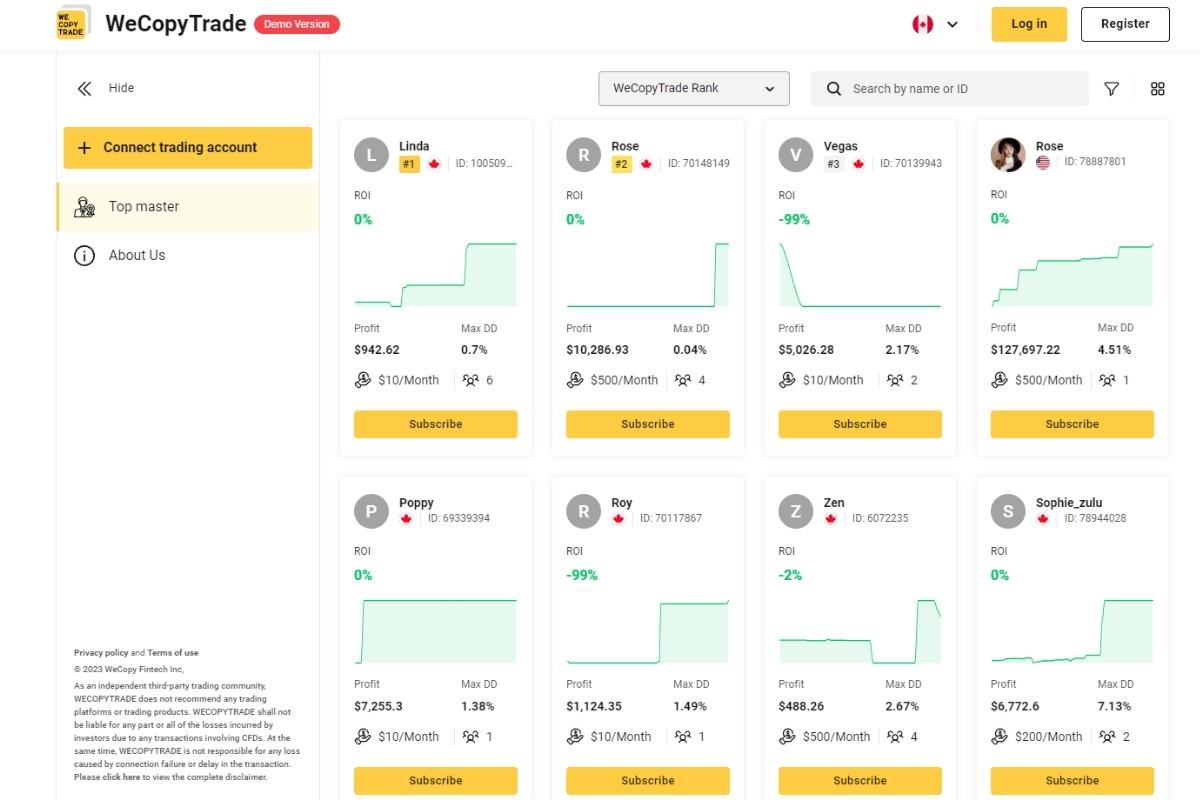

You can filter traders by their location, the markets they trade in (Forex, cryptocurrencies, commodities, stocks, indices, or ETFs), their profit margin from the previous month (and up to two years ago), and other criteria.

This is what that search function for people looks like on WeCopyTrade.

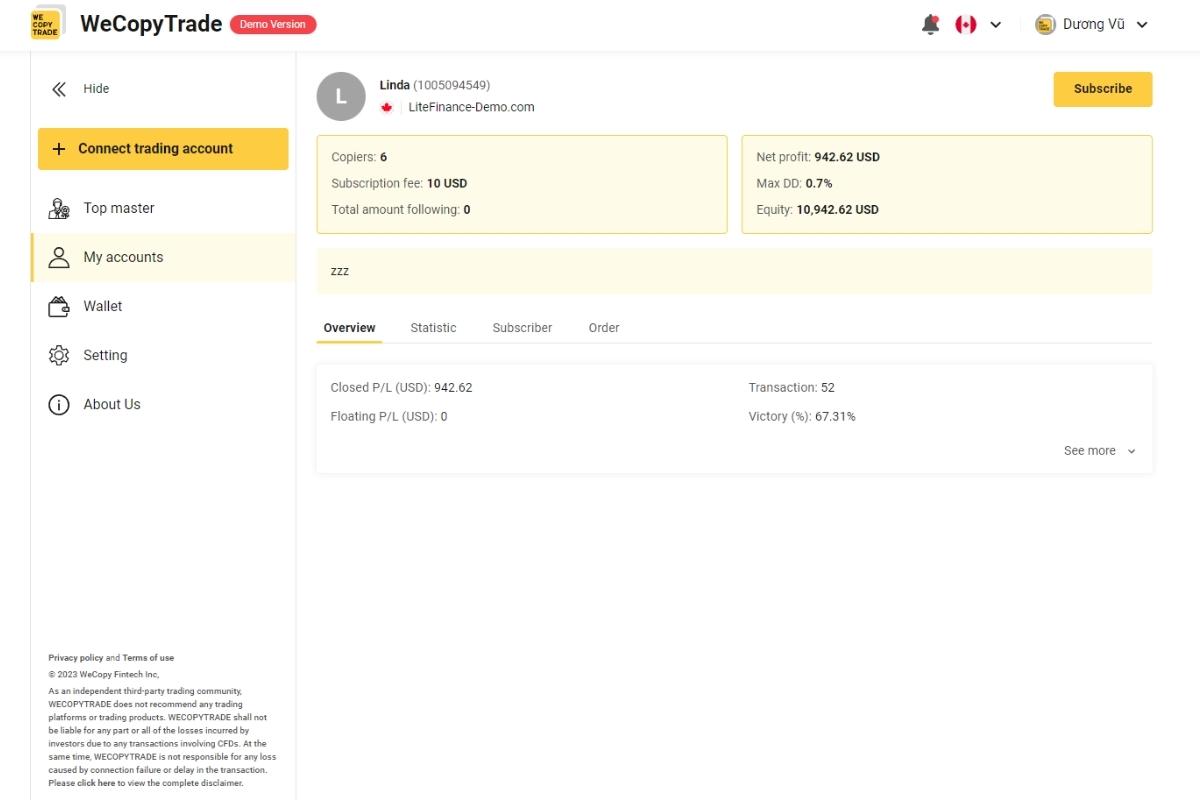

Step 2: Choose a Single Trader to Use the Duplicate Trading Technique

You have the option to review more information and then make a choice after carefully evaluating and selecting the trader who focuses on your favorite assets. Look! You can view information such as the number of followers, net profit, fee, equity, etc.

Step 3. Start “Copy Trading”

After deciding on the trader you want to follow, simply click on the “Describe” button. Before the platform may begin duplicate trading, you must set the traders’ information.

After making the initial deposit, you will start trading like the trader you just duplicated in your portfolio.

Step 4. Close the Investments at Any Time

Now that you see it, you are imitating this trader. You may view all the information about your copy investment on their page. The exact details may be found on your portfolio page.

You can quit replicating their traders and withdraw your investment at any moment. Although the trader you are copying already monitors their investments, there is no requirement for you to do so. However, you may decide to cease copying their assets.

To accomplish this, you must first discover the trader you want to stop copying in your portfolio, go to their website, go to settings, and choose “Stop Copying.”

Social Trading vs Copy Trading

There is a slight distinction between copy trading and a specific type of social trading.

By automatically replicating your account, copy trading ties up your account with other traders. In other words, if you make a profit, you succeed; if they lose, you also fail. Because traders make up most of the workforce, Copy trading is typically more passive. The procedure is often mechanized.

Contrarily, social trading is a more comprehensive method that combines social media with investment. With dealers able to communicate, share, and be seen by others’ actions, it frequently focuses on the community.

Both social trading and copy trading are profitable trading techniques. Choosing appropriate trading demands and preferences is crucial at all times. You may thus make use of the WeCopyTrade platform, which provides a variety of alternatives and solutions. It is crucial to pick the one that best suits your trading needs and preferences.

How to Successfully Copy Trade

How to copy trade? Following the activities you should do to duplicate trade.

- You must first decide on a broker with whom to partner. Select a licensed broker, such as WeCopyTrade, that provides security, a large range of assets, and attentive customer service.

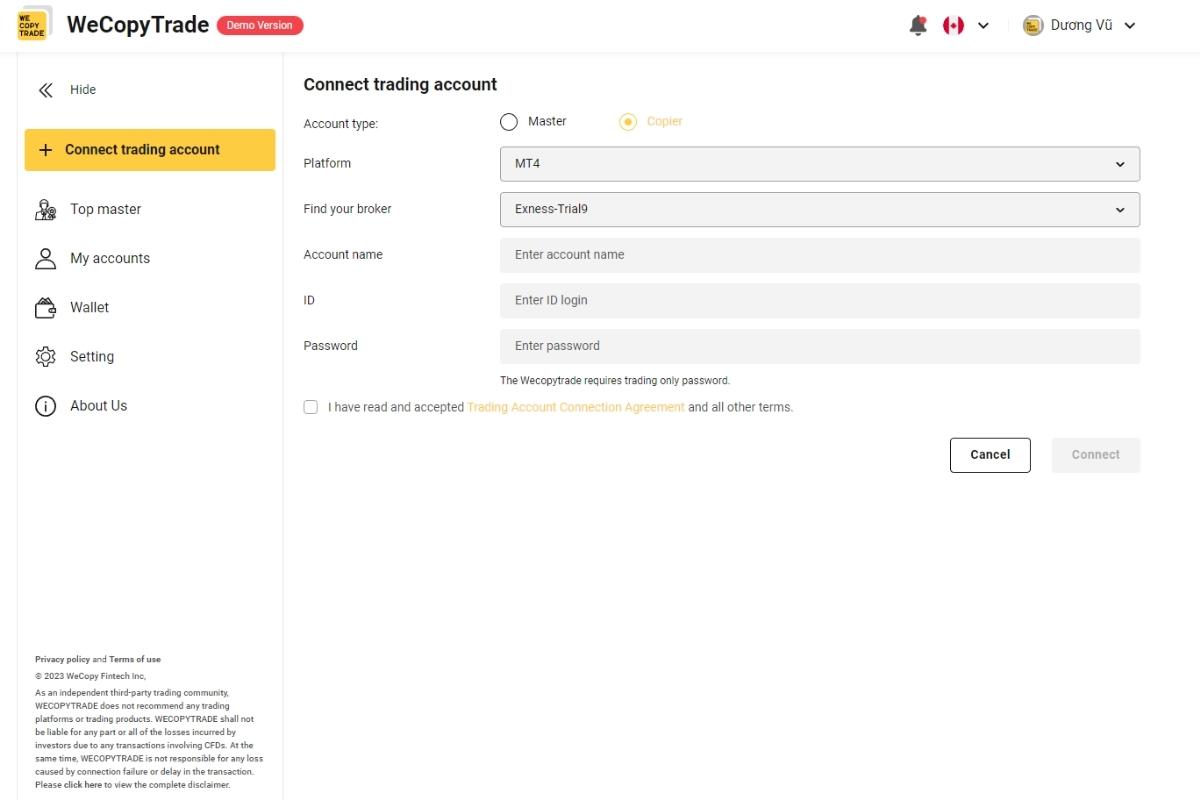

- It’s now time to create an account on a platform for automatic trading. Simply download the WeCopyTrade app from your mobile device or web browser to accomplish this. Well-known copy trading solutions, such as ZuluTrade, DupliTrade, and SignalStart, are also available at WeCopyTrade.

- Once your account is activated, a list of signal providers and their statistics will be shown. Typically, P&L and risk profiles are included. Choose the person or persons who will help you achieve your goals.

Copy Trade with WeCopyTrade

On WeCopyTrade trading platform, we give you a solid selection of some of the most reputable copy trading services. Additionally, you may view the most recent valid trade notifications and follow them along with their pre-set suggested parameters based on support and resistance lines by choosing SELL or BUY on WeCopyTrade website.

The items we provide are listed below:

- WeCopyTrade platform offers a wide selection of signal sources to pick from.

- Using the top program, which links to your trading account directly, do copy trading.

- Live trade notifications on WeCopyTrade services, both of which have won awards.

As conclusion, we’ve studied copy trading and learned how to copy trade with WeCopyTrade, as well as the benefits and distinctions between social trading and copy trading. Please get in touch with us on social media if you have any questions. Do you want to invest with WeCopyTrade at this time? Discover more about copy trading guides on WeMasterTrade.