What is a Funded Trading Program?

Pros and Cons of Funded Trading Program?

Pros

- Profit-sharing: Profit-sharing agreements are common in funded trading programs. This implies that traders get to retain a share of their winnings, which opens up the possibility of large profits.

- Scalability: Successfully financed traders may be eligible for extra financing as they satisfy performance goals. This enables them to expand their trading activities and enhance their prospective earnings.

- Ease of Access to Capital: Traders that engage in this kind of financing program have cash available to them that they would not have had otherwise. A trader may still earn money by making transactions based only on their knowledge and ability.

- Risk Management Conditions: The best forex trading systems have a broad range of risk management rules and restrictions that protect both the funding business and the trader. These settings make it straightforward for new traders to learn skills that will help them in the future while trading with real money.

- Realistic Trading Conditions: In contrast to demo accounts and other tools designed to teach traders the ropes, a forex sponsored trading program often employs real money. Unlike practice accounts and other simulations, this exposes inexperienced traders to the genuine conditions they would encounter while trading with their own money. It is preferable to practice trading with real money rather than virtual currency for the greatest outcomes.

- Professional advice and assistance from the company or provider: Some funded trading programs provide training resources, current information, mentoring, and assistance to help traders improve their skills and knowledge and achieve success. This is particularly useful for novices understanding the subtleties of the industry.

Cons

- Limited freedom and independence: Traders must follow the firm’s unique guidelines. This may hinder their capacity to capitalize on certain market possibilities.

- Risk of losing funded capital: While traders are not risking their own wealth, they may lose access to the funded account if risk management criteria are not followed or performance objectives are not met.

How to Choose the Suitable Funded Trading Programs?

Overall impressions

Value evaluation

Examine the elements of the supported program

Firm partnership terms

Meet Your Condition

- Experience: They often target amateurs with the potential to become skilled traders in the future. Others are experienced professional traders seeking a financial increase. Determine your level of expertise before picking a program, and then choose one that matches it.

- Capital: Different sponsored forex trading methods need different capital. Consider funding before choosing a program. Know what you can safely operate with.

- Time: If you just have a little time to trade, you shouldn’t choose a professional trading option that demands long market hours. If you’re short on time, choose a smaller product with fewer prerequisites.

Funded Trading Programs of WeMasterTrade

- WeMasterTrade gives a custom package for all kinds of traders.

- There is no longer any assessment procedure or difficulty; we fund you instantly and also double their trading account whenever you hit the 10% profit target.

- Use the WMT fund account to duplicate trades from top traders at wecopytrade.com to ensure consistent gains.

- Provide an accompanying training program for new traders with Funded Trading.

- Profit share starting at 60%

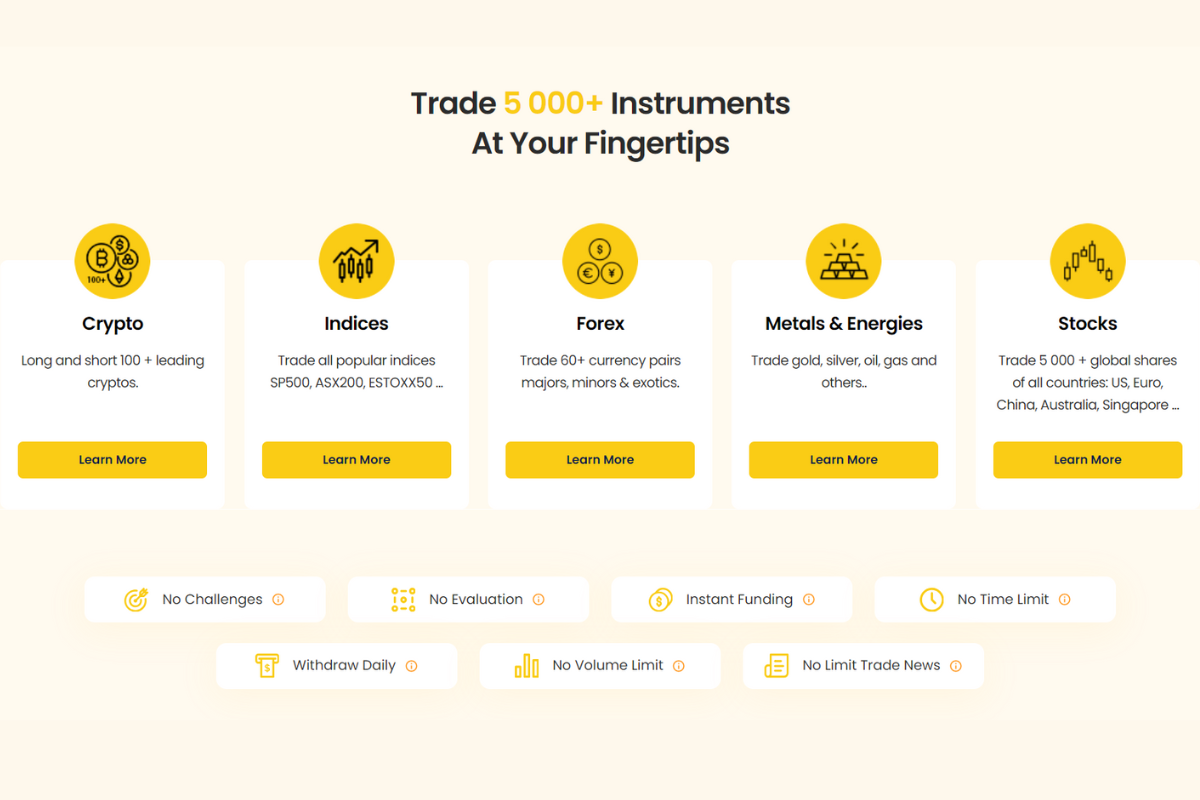

- Diverse markets such as Crypto, Forex, Stocks, Indices, Metals,…

- WeMasterTrade offers low-cost financing options for younger traders.

- Provide flexible trading circumstances so that you may earn money anywhere in the globe at any time; allows you to hold positions overnight and on weekends (for aggressive accounts only).

How to Start a Funded Trading Program with WeMasterTrade?

- Step 1 – Registration: WeMasterTrade (WMT) has a very easy-to-use interface and can help you set up your account easily. Sign up for an account with WMT. After signing up, you will receive an email to verify your account. Click on the link in your email to complete the registration steps.

- Step 2 – Questionnaire: Once you successfully create an account, you need to answer some questions to qualify with the system. There are no right or wrong answers to the questions, as long as you submit your answer, WMT will move you to the next step.

- Step 3 – WeTraders:

1, Once you submit your answers in step 1, we activate this section right away to allow you to buy the trading account

2, There are two types of packages that customers can activate. Each package will start from $10,000.

Scale up: Double trading account when hit 10% profit target.

Funding limitation: Fund up to $2,000,000 (2 million dollars) trading capital to trade.

3, Due to high demands, any request for trading capital under $200,000 will be approved immediately. If the amount is higher than that, you must submit the request to risk management for approval.