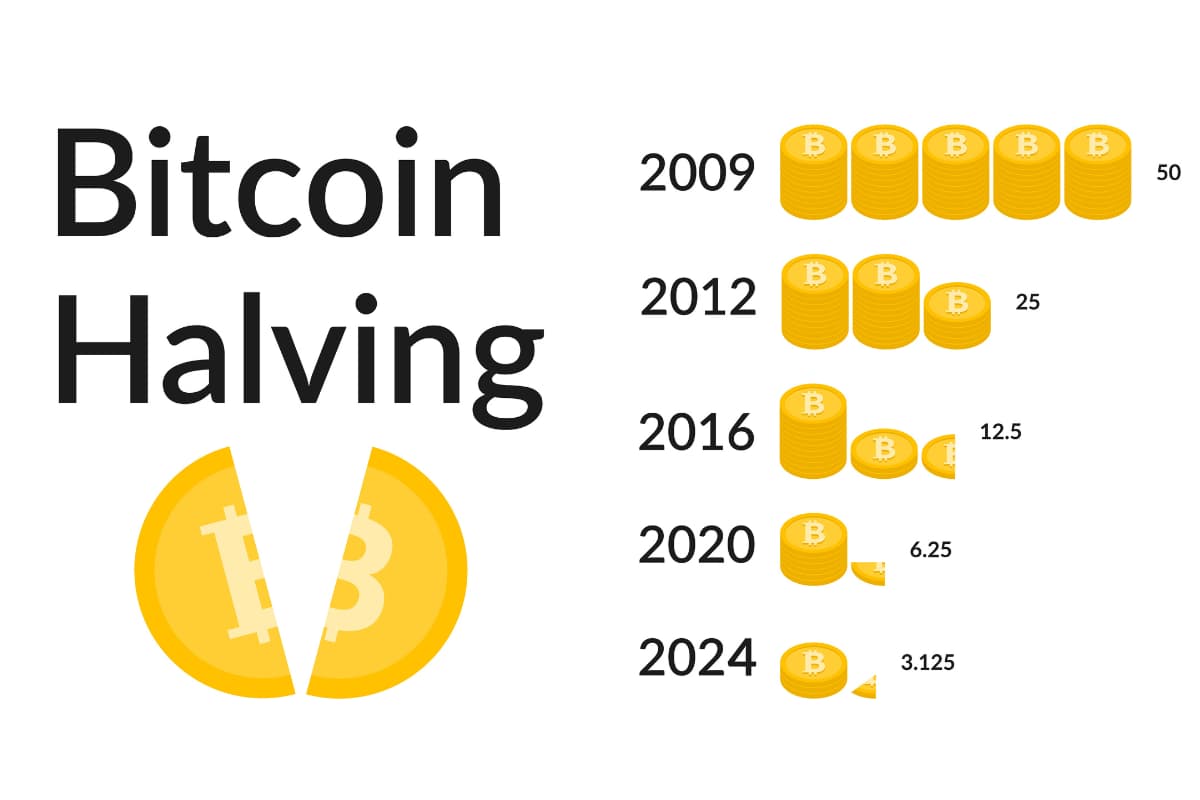

What Bitcoin Halving 2024 Means for Your WalletThe Bitcoin halving event in 2024 was an important change in how the digital currency Bitcoin works. Bitcoin halving is when the new supply of Bitcoins released each day gets cut in half. This happened previously in 2012, 2016, 2020, and in April 2024 it happened again. The halving affects the overall Bitcoin supply and can impact the price of each Bitcoin. In this blog post, we will discover what exactly the Bitcoin halving 2024 meant for the value of Bitcoin in your own wallet.

What is Bitcoin Halving 2024?

A Bitcoin halving is an event when the reward for mining new blocks is cut in half. This means miners receive 50% fewer Bitcoins for verifying transactions. This happens every 210,000 blocks added to the Bitcoin blockchain, which usually works out to about every 4 years. This continues until the total supply of the network reaches 21 million Bitcoins.

Bitcoin halvings are important to traders because there will be fewer Bitcoins made each day. With supply getting smaller but demand staying the same, the price could go up. This has happened after earlier halvings, with Bitcoin gaining a lot of value. But each time is different – you never know exactly how interested people will be in buying Bitcoin later on. While the price tended to rise after past halvings, nothing guarantees that will happen again.

Why does Bitcoin Halve?

There are a few key reasons why Bitcoin halvings occur:

- Supply control: Bitcoin has a fixed maximum supply of 21 million coins that will ever be created. Halvings are built into the code as a way to gradually reduce the rate at which new coins are released into circulation over time. This helps control the long-term supply.

- Miner incentive: Halvings ensure Bitcoin miners remain incentivized to secure the network and process transactions. By cutting block rewards in half periodically, it prevents mining from becoming centralized or inefficient over the long run as fewer coins are issued.

- Deflationary asset: By permanently decreasing annual Bitcoin inflation, halvings make Bitcoin more deflationary and potentially more attractive as a long-term store of value. The rate at which new coins enter the total supply decreases over decades.

- Scarcity effect: As the supply released each day gets smaller due to halvings, it could theoretically encourage the price to rise long-term in response to increasing scarcity – if demand remains stable or grows. Past halvings have lined up with bull market cycles.

So in summary, halvings are part of Bitcoin’s programmed supply schedule and are key to maintaining network security, scarcity over time, and possibly long-term price appreciation driven by reduced inflation/increased scarcity.

Does Bitcoin Halving 2024 Affect the Bitcoin’s Price?

Bitcoin halving 2024 reduced the reward from 6.25 BTC to 3.125 BTC per mined block on April 19, 2024. This event occurred around one month after Bitcoin achieved an all-time high of $73,750 on March 14, 2024.

There was not much immediate effect on general investor after the halving, as the price stayed stable around $64,000 per BTC. As of May 3, 2024 at 12:00 p.m, IST, Bitcoin was trading at $59,348.70.

Higher price would motivate miners to continue processing Bitcoin transactions.

How to Trade the Bitcoin Halving

There are two different approaches to trading Bitcoin halving. You may speculate on the cryptocurrency using derivatives such as CFDs, or acquire the coins straight through an exchange.

To trade the Bitcoin halving, traders need to:

- Learn more about CFD trading on crypto

- Create an account or practice on a demo account

- Locate the “Bitcoin” on the trading platform

- Open your position

Strategies to Consider When Trading The Bitcoin Halving

Here are some strategies to consider when trading around the upcoming Bitcoin halving 2024:

- Buy Bitcoin before the halving happens: Many traders buy Bitcoin in the months leading up to the halving in anticipation that reduced supply may drive prices up afterwards. Having coins before the event means you can benefit from any price rise.

- Sell after the halving: Some traders believe the initial price surge after the halving may be short-lived. You could buy before then sell in the months after to capitalize on the typical run up in price.

- Trade altcoins correlated to Bitcoin: Other cryptocurrencies like Ethereum often move up when Bitcoin rises. Look for opportunities in altcoins that usually follow Bitcoin’s lead.

- Provide liquidity around the event: Earn fees by placing limit orders around the halving date and possible price volatility in Bitcoin futures and options markets.

- Diversify your trading strategy: Try different approaches like holding some coins long-term while also trading the volatility with other funds. This reduces risk if your timing is off.

- Use dollar-cost averaging: Buy a set dollar amount regularly over a long period to reduce the risk of trying to time sudden price jumps around the halving.

Research market cycles: Study how investor behavior and Bitcoin price reacted after previous halvings to get a sense of typical price patterns. But know each halving’s impact may differ.

When is the Next Bitcoin Halving Event?

The Bitcoin system is programmed to cut the reward for miners in half at certain points. No one knows the exact date but experts say it will likely happen around 4 years after the last time.

Halvings are meant to happen regularly so the network can adjust without major problems. However, many traders get very excited buying and selling Bitcoin around the time a halving occurs.

Usually, the price moves up and down a lot in the months before and just after a halving. But generally within a few months, the price tends to be much higher than it was. Other things also affect the Bitcoin price. But past halvings seem to eventually help increase the price even though it is volatile at first.

FAQs about Bitcoin Halving 2024

- Does Bitcoin Halving 2024 decrease the Bitcoin price?

Bitcoin halving 2024 lowered the reward for each mined block by 50%, from 6.25 BTC to 3.125 BTC (April 19, 2024). Bitcoin halving 2024 had no instant impact on regular investors, as the price stayed constant at roughly $64,000 per BTC. 1 BTC was exchanged for around $59,348 (May 3, 2024).

- Why does the Bitcoin halving event occur only once every four (04) years?

The Bitcoin halving is done to regulate Bitcoin’s supply and demand.

- When was the most recent Bitcoin halving?

The last Bitcoin halving occurred on April 9, 2024, reducing the reward from 6.25 BTC to 3.125 BTC per mined block.

Final Words

In conclusion, the Bitcoin halving 2024 ended up having major effects on cryptocurrency prices and investors’ wallets. As many predicted, Bitcoin rose tremendously in value after the halving reduced new coin rewards. However, other crypto prices also fluctuated wildly at times. For those who strategized around the event, the Bitcoin halving 2024 presented both opportunities and risks to their portfolio balances.

Looking back, being informed about the potential impacts of the halving helped some traders and investors navigate the market changes it brought. For more useful trading tips, please visit our WeMasterTrade Blog.